Call Options: Here’s How to Profit off a Dip

By: Steve Smith

Rent-A-Center (RCII) is set to report earning after the close Monday, Oct. 30. I’m buying call options in anticipation of a better-than-expected report and for the stock to squeeze out the massive short interest.

Now that I’ve told the punch line, here’s the setup.

The company operates over 1,400 retail stores that offer home furnishing products, from couches and beds to appliances and TVs, either on a rental or a lease to own basis.

It’s a business that targets (preys upon) a lower income customer base and makes most of its money by charging above-market interest on the credit they extend.

And similar to the payday loan industry such practices came under regulatory scrutiny a few years ago, causing a contraction in lending and margins.

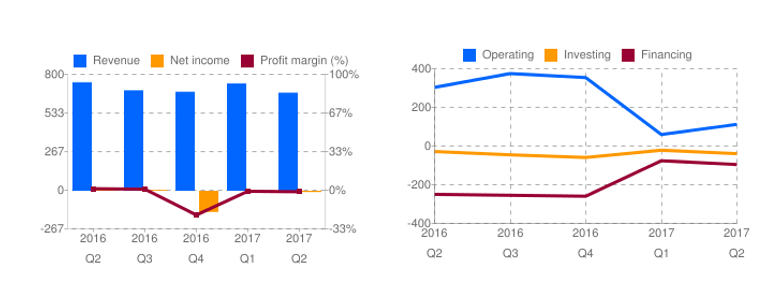

Combined with general pressure physical retail and RCII’s lack of online sales, the company is expected to post its third loss over the past four quarters. And it’s easy to see why; shares are down some 75% over the past two years.

Here are some other positives:

- The stock is near support at the $9.50 level.

- A dividend cut, rumored on Friday, is now priced in.

- Revenues held flat and lending and operating income have turned back up, as unfortunately renting/leasing at high rates is still the only option for many people.

- Short interest is now a whopping 61% of the float.

Rent-A-Center is based in and has most of its locations in Texas. It is once again positioned to benefit from others’ misfortune, as flood victims are forced to find fast and affordable (at least in the short term) replacements for damaged appliances and furniture.

All this adds up to a lot of bad news being priced into the stock and is setting the shares up for a nice short squeeze when the company delivers better than expected numbers.

THE TRADE:

I am purchasing from the Nov. 10 call options for $0.50 per contract.

My target is for the stock to rally above the $11 level and for the calls to be worth more than $1 for a 100% gain.

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Options Trading: Have a Look at Pizza and Gaming Stocks

December 8, 2017 -

Options Trading: Try This Alternative to Covered Calls

December 5, 2017 -

Best Buy Stock: A Good Bet Based on Earnings

November 15, 2017

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.