Options: Short-Term Money-Making Opportunities

By: Steve Smith

Source: Shuttershock.com

All the political and policy noise is about to brushed aside by what really matters for stock prices; earnings. And this is shaping up to be one of the most interesting, and possibly treacherous, earnings seasons in many years. Here is what you need to know.

Earnings season kicked off on Friday with big banks such as JP Morgan (JPM), Citi (C ) and Wells Fargo (WFC) all delivering better than expected results.

The stocks initially opened higher, but within the first hour of trading, all reversed lower. It may a have been a case of the company-specific good news being overwhelmed by a broad market sell-off. But this may also be a canary in a coal mine of what’s to come.

For some active traders, these jolts of information and the accompanying stock price movement represent terrific short-term money-making opportunities. And many will try to juice the returns by using options.

Before getting to some of the concepts and strategies that can be employed in playing earnings reports, let me provide the caveat that all earnings plays are extremely speculative and should only involve a minimal allocation of risk capital. The challenge trading earnings is that there are many variables that need to be accounted for, and correctly forecast.

Not only must you determine if the company will meet estimates (and have those estimates recently been lowered or raised) but also what kind of guidance will be provided. But what has already been priced into the stock — whether it’s recently run up or sold off. And most importantly, what percentage price move the options are pricing in as measured by their implied volatility

Prepare for Post Earnings Premium Crush

This tendency for a Post Earnings Premium Crush (PEPC) make understanding the relative “expensiveness” of options and the magnitude of the price move being priced crucial to improving the probability of achieving a profitable trade.

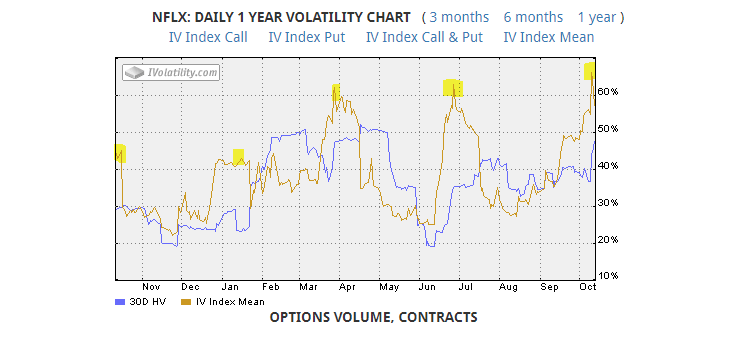

Here’s a great visual look at how Netflix (NFLX) historical volatility versus its implied volatility diverges then converges before and after earnings reports.

Netflix options usually “price in” at 10%. Meaning, if you just buy options outright, whether puts or calls, and the stock moves less than the expected 10%, you lose.

Expensive is Relative

On face value, Google’s (GOOGL) which reports October 25 options with an implied volatility of around 45% — appear “cheaper than Apple’s. But when looked at, relative to each stock’s 30-day realized or historical volatility (HV), Google is actually more expensive. Google’s HV is 19%, meaning the options IV are running a near 90% premium compared to Apples HV which is 22%, meaning its options are “only” a 45% premium. A great free site for tracking options volatility, both historical and implied, is iVolatlity.com.

The reason most options see a decline in implied volatility — following the report — is that it’s wise to use a spread rather than the outright purchase of options in making a directional bet. The next step is using that implied volatility level to determine what size price move is being estimated, or priced into the options. This will help you determine which strike prices you might want to use in setting up your position.

Premium sites such as Bloomberg.com provide the data one can use to perform the calculation relatively easily. The down and dirty formula would be to simply take the price of the at-the-money straddle — add the price of the puts and calls and divide that total by the price of the underlying shares.

Given that most of the popular issues will have weekly options listed for their earnings reports, it would make sense for those looking for the speculative action of earnings plays to stick with the leverage of these short-term contracts. But remember, this leverage cuts both ways; if you are wrong to expect to lose 100% of your allocated capital.

I’ll drill down into some specific earnings options trades, which use PEPC in our favor, as the season plays out.

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.