Oil Plunges and Natural Gas Soars, What to Make of These Extreme Moves

By: Steve Smith

A month-long slide in oil and sudden surge in natural gas price is impacting global stocks, the bond market, hedge funds, and consumers. Here is what is causing the moves and what might happen next…

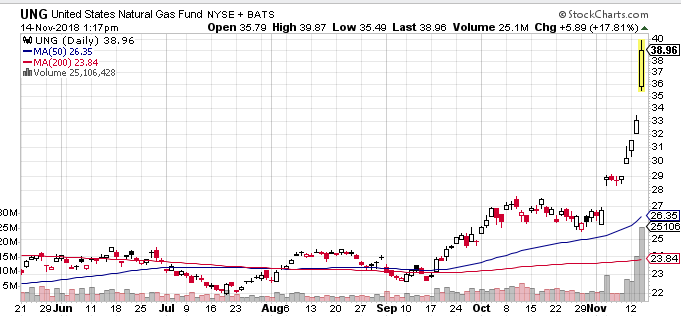

In natural gas, which is widely used to heat homes in northern U.S. and Canada, a change in weather forecasts over past few days has pushed futures to $4.40 per BTU, which is a 35% surge in just one week, and settled at its highest level since February 2014.

Source:Stockchart.com

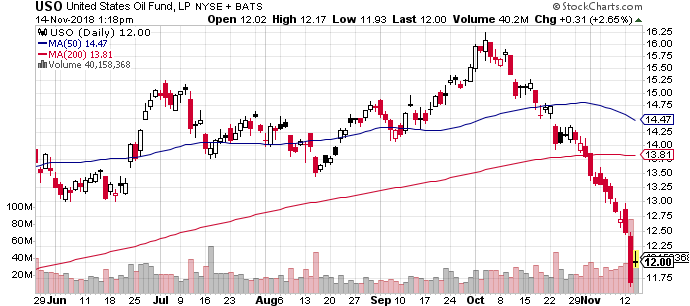

Meanwhile, oil has taken a steep tumble, going from a year high of about $76.50 to a new 52 week low of $55.50, which is a 28% decline in less than a month. This month included a record 12 consecutive down days for oil; the most rapid in the 45 years of tracking the data.

Source:Stockchart.com

Source:Stockchart.com

The Big Unwind

The opposing price moves in natural gas and oil has accelerated over the past few days, as many people believe…

Continue reading at STOCKNEWS.com