3 Recession-Proof Stocks to Buy in January

By: admin

Recessions come in all shapes and sizes, so it’s a good idea to think about buying stocks to deal with different types of recessions.

If you are worried about a deep and lasting recession, auto parts retailer O’Reilly Automotive (NASDAQ:ORLY) is a good place to start looking. Meanwhile, beverage-can maker Ball Corporation (NYSE:BLL) will thrive in a mild recession accompanied by a fall in raw material prices such as aluminum. Life sciences and diagnostics company Danaher (NYSE:DHR) could also do well in a recessionary environment where governments decide to support the economy with spending on healthcare.

Let’s take a look at the investment case for all three.

O’Reilly Automotive

When a recession occurs and consumers start feeling the pinch, they tend to hold back on making high-ticket purchases of discretionary items like automobiles. Instead, they have a tendency to run existing cars longer, and since older cars tend to need more servicing it means more demand for auto parts — great news for O’Reilly.

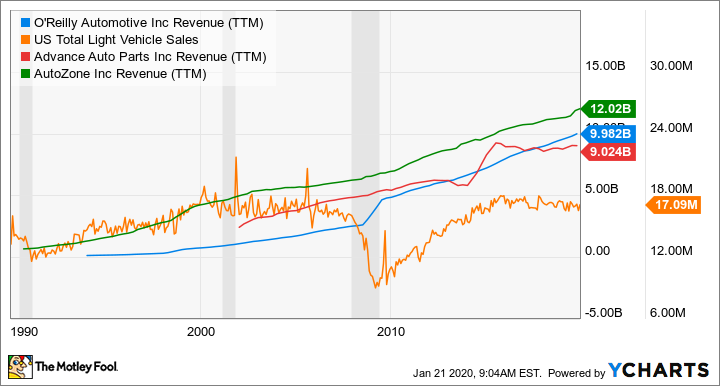

Here’s a chart showing how light-vehicle sales fall during recessions. Moreover, note how the revenue of the largest listed auto parts retailers tends to increase during recessions.

ORLY REVENUE (TTM) DATA BY YCHARTS

In a sense, O’Reilly is a kind of stock that can thrive in economic adversity and for that reason alone it’s worth consideration for investors worried about a protracted recession. That said, the stock’s valuation isn’t particularly attractive and there are question marks around the sector’s long-term margin outlook given Amazon.com‘s entry into the market.

ORLY EV TO EBITDA DATA BY YCHARTS

Ball Corp

The case for buying Ball Corp rests on the idea that end demand for beverage cans and personal care product containers will hold its own in an economic slowdown. Ball’s core end demand is definitely in the consumer staples camp, and there’s also the secular trend toward the use of more environmentally friendly aluminum rather than plastics for packaging. In fact, the latter is largely behind CEO John Hayes’ belief that the long-term growth rate of beverage-can unit volume will now be closer to 4% rather than the previously assumed 2%.

In addition, Ball has customers on multi-year supply contracts — Coca-Cola, Anheuser-Busch InBev, Molson, and Unilever are significant customers — so its competitive positioning is sound.

In the… Continue reading at Fool.com