The Correct Mindset to Have After the Stock Market Plummets

By: Steve Smith

Every investor wants high returns but with low and limited risk. This especially the attraction of using options. But in times of high volatility and sharp straight line moves such as has occurred over the past week the losses can be sweeping and total.

So, the question is how do you handle big drawdowns? Before getting to some specific behavior it’s good to step back for a longer-term perspective versus short term trading.

The past weeks’ near 15% drop is the largest and fastest correction from all-time highs in the past 70 years. But while the velocity has been notable the actual size of the decline is well within historical norms.

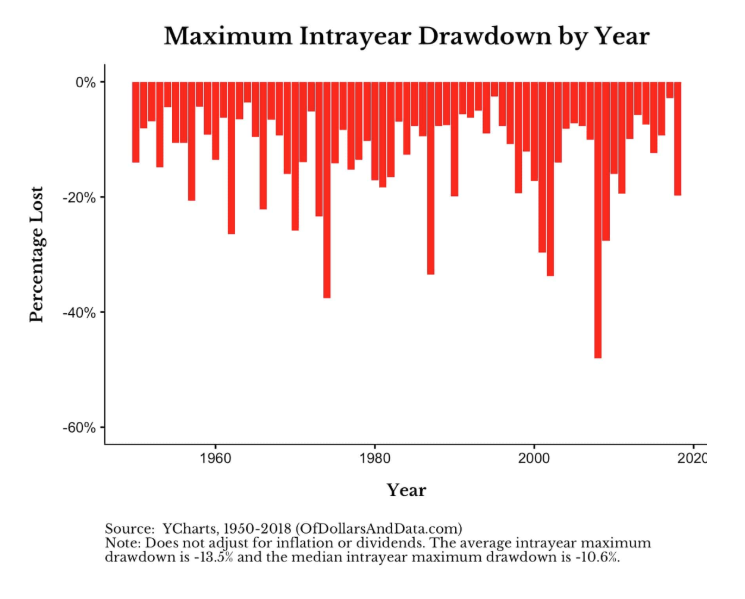

Since 1950, the average maximum intra-year drawdown for the S&P 500 has been 13.5% with a median drawdown of 10.6%. This means that if you had bought the S&P 500 on January 1 of any given year, on average, the market would be down by 13.5% at some point during the year:

Also, it’s good to note that since the financial crisis in 2008-2009 there have been multiple ‘events’ that would have provided reasons for people to sell.

Which of course would… Continue reading at StockNews.com