Using Iron Condors to Profit in This Volatile Environment

By: Steve Smith

The stock market continues to fluctuate wildly, and the VIX, a measure of implied volatility is sticking above the 40% level. That’s down from the recent high of 85% but still well above normal levels, but still ranks in the top 10% of all-time readings.

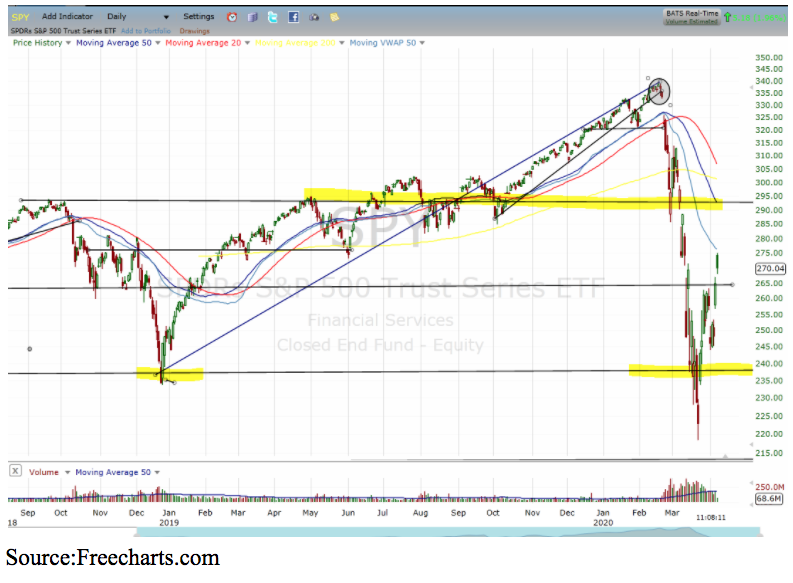

This means options’ premium is all plumped up and ready for feasting upon. Two weeks ago, with daily moves in excess of 6%, trying to predict a bottom, or even how high a bounce might rise, seemed a fool’s task. But, it now looks like the “SPDR 500 (SPY)” has found a range, albeit a large one, between the recent low around $230 and the resistance from the $295 gap down.

The trade I will focus on is in the SPY with expectations that it will remain between $230 and $295 for the next few weeks.

But, before I get to the specific trade, let’s discuss… Continue reading at StockNews.com

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.