Is There Value in Value Stocks?

By: Steve Smith

With stock indices raging back to levels prior to the pre-COVID 19 levels many people are wondering if this is a time to look at value stocks. It has been well documented that growth has outpaced value for over a decade with technology leading the way. The tech-heavy is “Nasdaq 100 (QQQ)” is only 3.5% away from the all-time high hit February while the broader “S&P 500 (SPY)” is still some 10% away. Meanwhile the “Russell 2000 (IWM)” is the main reason for the disparity is the QQQ is heavily weighted with large-cap tech/growth stocks while the IWM is saddled with value stocks that come from sectors such as energy and regional banks.

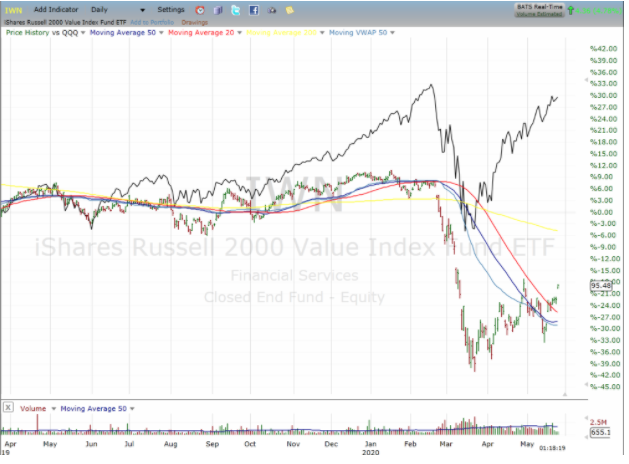

When we drill down and compare the “Russell 2000 Value (IWN) to the QQQ you see the separation began in earnest last year and then went into overdrive when the virus hit. Again, the explanation is simple; the QQQ is filled with stay-at-home plays such as “Amazon (AMZN) and “Netflix (NFLX)” while the IWN has a ton of energy like “Chesapeake (CHK).”

So, the question is, is value a… Continue reading at StockNews.com