Did Stocks Hit a Peak Last Week?

By: Steve Smith

Stock market action this week has been characterized by rotation from the “Nasdaq (QQQ – Get Rating),” which as of midday, will have declined by 1.7% compared with gains in both the “S&P 500 (SPY – Get Rating)” and “Russell 2000 (IWM)” which increased 1.1% and 0.9% respectively for the week.

Of course, the QQQ’s are still far outpacing the SPY and IWM for the year — some profit-taking and rebalancing out of the big tech winners like “Amazon (AMZN)” and “Apple (AAPL)” and into things like financials and consumer staples. But, given that the stock market has already been narrow, it can ill afford to lose the generals when the soldiers were already dragging and the broad economy is likely to face headwinds for months to come.

Next week, we’ll get important earnings season reports from Microsoft (MSFT) and then AAPL and “Alphabet (GOOGL)” next week, which could determine whether they can regain their lead. But, in what might be seen as a shot across the bow “Netflix (NFLX)” is trading down almost 10% — following last night’s moderately-disappointing earnings report. This may indicate that some of the companies, which benefited from the COVID-19 lockdown, and whose stocks ran up some 50%-100% over the past few months, have now fully priced.

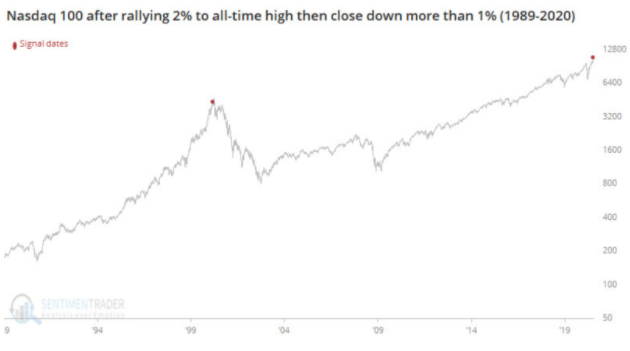

From a technical chart standpoint, last week’s major reversal could spell big trouble. Reversals are usually reliable signals for market turns, and last week was only the second time in 30 years we saw a 2% rally into new highs, only to reverse and close down over 1%. The only other instance was the peak of dot.com in 1999. This could definitely be a sign we just had a blow-off top after a near parabolic move.

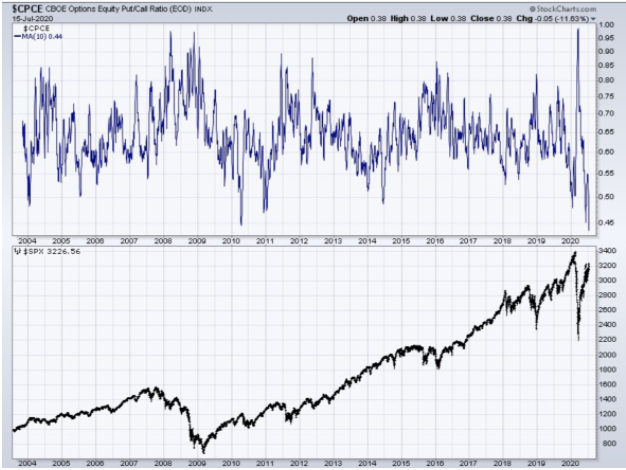

While sentiment indicators did not get too euphoric, there were some data points that hit some historical levels indicating complacency. The put/call ratio hit an all-time low of 0.39 which indicates nearly three times and calls were being purchased than puts.

It’s a sign investors want to get additional upside exposure and are not worried about buying puts for portfolio protection against the downside.

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.