Seeing a Credit Spread In Action

By: Steve Smith

I had the pleasure of joining Adam Mesh on our webinar last night to discuss the state of the market and what options strategies I’m employing now. My response was I’m looking at credit spreads.

That is a strategy in which you sell a near-the-money open while simultaneously buying any further out-of-the-money options. The position collects a net credit of premium which you keep if the underlying shares don’t breach the strike price. I’ve written about the dynamics of credit spreads and how to calculate returns.

Now let’s look at when in real-time. The following is part of Alert I sent out to Option360 members yesterday. It is still actionable today and my gift to loyal readers. Now you get to see and hopefully participate, in one of these trades in real-time. Fastly (FSLY – Get Rating) has been a hot fast stock. It provides edge computing (cloud) for businesses to run real-time remote. But it has a crazy valuation in that it is still a money-losing operation. The stock had been on a huge run but got slammed pot earnings not because the numbers were disappointing, they actually “beat and raised,” but:

1) It turns out 13% of revenue comes from TikTok and we know they are under the microscope and possibly will be acquired by Microsoft (MSFT).

2) They offered a secondary stock offering

3) simple and rational profit-taking.

The stock has now come down to support near the $75-$78 level.

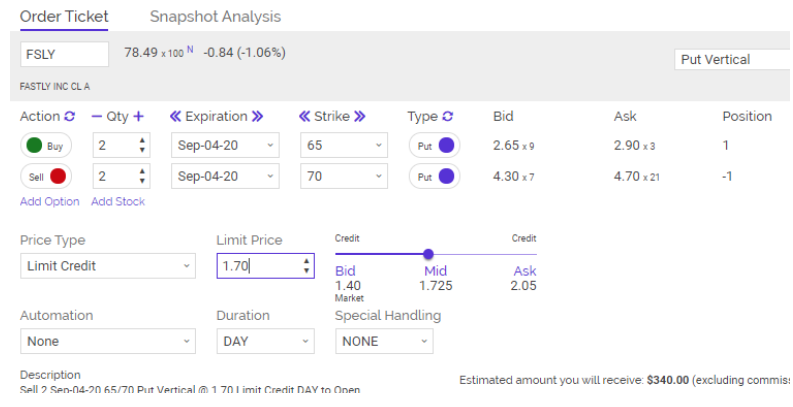

ACTION:

-Buy to open 2 contracts FSLY Sep (9/04) 65 Put

-Sell to open 2 contracts FSLY Sep (9/04) 70 Put

For a Net Credit of $1.70 (do not go below $1.55)

All we want is for shares of FSLY to stay above $70 for the next 3 weeks and we collect $170 per contract per spread.

This is a way in which application of the appropriate options strategy, especially one that benefits from time decay, can deliver solid profits.

Click here to learn more about author Steve Smith’s unique and profitable approach to trading.

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.