How I Made a 64% Average Return Over the Past 5 Years

By: Steve Smith

I’ve been a professional options trader since the age of 22 when I became one of the youngest members of the Chicago Board of Options Exchange.

In the 33 years since I’ve been involved in all aspects of the trading industry; from a columnist for publications such as TheStreet.com to consulting as a risk manager for a multi-billion dollar hedge fund to running various options based newsletters.

I’ve never been as proud or happy as what I’ve been doing with the Adam Mesh Trading Group through my Options360 platform.

The Options360 Service is an “unconstrained” option-based newsletter. Meaning it employs a variety of option strategies—both long (bull) and short (bear) and debit and credit positions– to seek optimal risk-adjusted returns.

I rely on an approach I refer to as the “3 Ps”; Process, Probability, and Profit.

To learn more about my 3P approach you can watch this presentation

The goal is to identify attractive opportunities and apply the appropriate option strategy which aligns with the trade thesis.

As a former member of the Chicago Board of Options Exchange, I cut my teeth acting as a market maker on the floor of the exchange. This means I take a very option-centric and math oriented approach.

To produce profits consistently over time I don’t need to be right all the time, I simply need to control my risk and maximize my gains.

My Goal:

Set up trades with a 2:1 risk/reward and win 60% of the time.

This would deliver a 120% return.

Aggressive yes, but not unrealistic or impossible. I have achieved these results year after year.

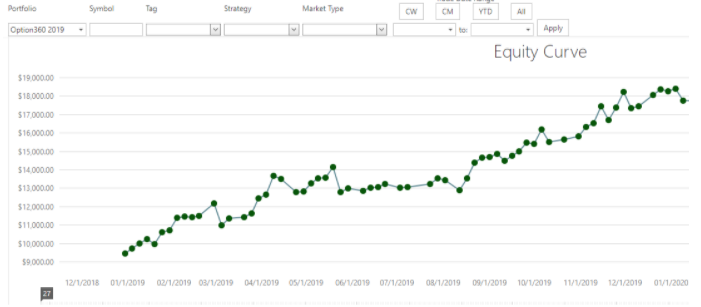

The profits have come consistently through markets ups and down and during periods of low and high volatility.

Five years of above-market returns:

- 2015 gain of 122%

- 2016 gain of 39%

- 2017 gain of 61%

- 2018 gain of 67%

- 2019 gain of 77%

- 2020 gain of 28.3% as of July 30th

The upshot is I take my experience and expertise as a professional options trader and bring it to you in a format that is easy to understand and execute.

Right now, we are offering a special one month trial for just $19 per month

When you sign up for Options360 this is what you get:

- Three to four trade recommendations per week.

- Alerts (and texts) are sent with a full explanation of the rationale, parameters, and expectations for each trade.

- Real-time execution and tracking.

- Monday morning Outlooks

- Bi-Monthly live web calls

- Access to my direct email*

*This last item is one I really pride myself on. Current members can attest to how quickly and thoroughly I respond to all questions, queries, complaints and complements.

Get the one month trial for just $19.

Let’s do options the right way, together!

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

2 Trades I’m Focusing on Amid this Week’s Volatility

November 10, 2020 -

We Have a Winner?

November 9, 2020 -

Why It’s Time for You to Go ‘Long’

November 7, 2020

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.

![[Veterans Day Special] I Want to Say, ‘Thank You’…](https://optionsensei.com/wp-content/uploads/2018/10/shutterstock_415926982-120x120.jpg)