The Bulls Keep Running, While…

By: Steve Smith

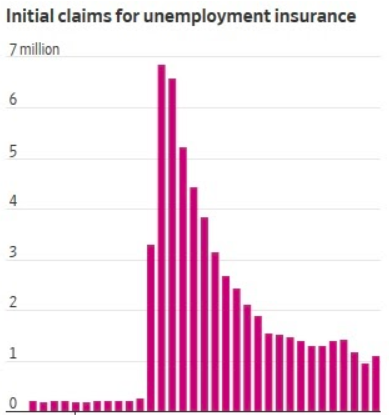

We see more evidence that the economy is not the stock market with the unemployment numbers from Thursday.

The WSJ reports that new jobless claims were up this week to a seasonally-adjusted 1.1 million.

That’s new claims – THIS week.

You can see that the claims are still way up from the pre-COVID shutdown.

Even in the worst part of the Great Recession in 2008, new jobless claims never can close to 1M per week.

Today, 1.1M new claim this week represents a substantial improvement from the worst weeks back in March.

Restated, our substantial improvement is still FAR worse than the worst weeks in 2008!

And despite this news, the bulls just keep marching.

I point this out to readers for two reasons. First, as I wrote just a minute ago, the stock market is not the economy. So when you hear this kind of negative economic news don’t start to think that’s a negative for the markets.

It might be, or it might not be. We need to look at the technicals to find out.

And second, don’t get scared and start thinking it’s time to pull out. It is time to trade rather than buy and hold, but it is NOT time to get out of the market.

A while ago I did a special webinar training with my publisher Adam Mesh to reveal to his readers how I find setups, vet them, and trade them for a profit.

With Adam’s permission, I am sharing the training with you, because I am sure you will find it valuable.

There’s no charge, just click here and watch.

And also, make sure you grab a trial subscription to Options360. It’s just $19, and I cover this and a number of other economic issues on the bi-weekly members-only webinars.

Plus, I give you trade ideas weekly. The model portfolio is up 28% YTD, vs the S&P 500 which is up something like 4%.

If you don’t like it, you let the trial expire, and no worries. If you do like it, and everyone does, stick with it. A lot of people have the chance to pay for a full year just during the trial.

To Your Success,

Steve

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

2 Trades I’m Focusing on Amid this Week’s Volatility

November 10, 2020 -

We Have a Winner?

November 9, 2020 -

Why It’s Time for You to Go ‘Long’

November 7, 2020

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.

![[Veterans Day Special] I Want to Say, ‘Thank You’…](https://optionsensei.com/wp-content/uploads/2018/10/shutterstock_415926982-120x120.jpg)