A Netflix Trade That Can Make You a 300% Return

By: Steve Smith

In yesterday’s article, I discussed the first three trades made in the Earnings360 service, all winners, and offered a chance to sign up for it while we’re still in the early days of earnings season. Today, I extend the offer and go full Monty by revealing a trade that I’ll be making in Netflix (NFLX), which reports earnings after the close today.

The prior trades were somewhat conservative, resulting in an average 30% return. Now, I’m getting more aggressive and shooting for a 200%-300% profit. Below is the exact Alert members of Earnings360 received earlier today.

1.NFLX

Price: $525

Reports: 10/20 A,C.

Implied Volatility: 114%

Expected Move: 9.8% or $51.50

Strategy: Bullish Butterfly

Entry Net Debit $3.60 (do not go above $3.85)

Exit Target: Net Credit $8.00+

NFLX is the streaming giant which has become almost the default option for cord-cutting and almost synonymous with “T.V”. I’m a happy customer and think it’s a great service but have always been a skeptic in terms of its stock on the belief the cash burn, debt, and valuation would be resolved by a much lower price.

I was wrong and thankfully, I stopped trying to short it several years ago.

- This quarter’s shaping up to be strong with 21% Year-over-Year revenue growth and a big 45% YoY EPS growth to $2.13 per share.

- The key metric’s always subscriber growth, especially on the international front as the U.S’s mostly saturated.

- COVID has proved an accelerant to the secular trend towards streaming and despite an influx of new competitors from Disney (DIS) to HULU and Alphabet (GOOGL) YouTube down to legacy networks, NFLX has not only first mover advantage but also a large library and original content offered at an attractive price point.

- One of the rubs is NFLX shares being up some 75% since the March lows, and valuation is still sky-high just as investors are becoming increasingly cautious towards big tech/stay-at-home stocks.

- I predict that strong international growth will win the day and NFLX pushes higher.

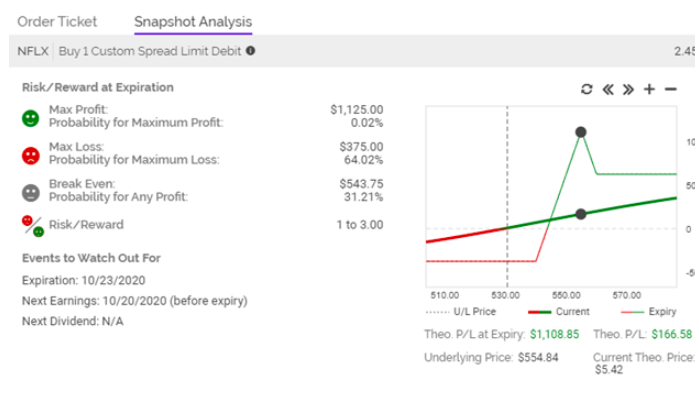

I’m using a bullish butterfly with a ‘pinched’ upper strike, sometimes referred to as an unbalanced or ‘broken wing’ butterfly. Unlike a traditional butterfly — with equidistant strikes — which need shares to land within a specific range, it allows us to profit regardless of how high the stock goes.

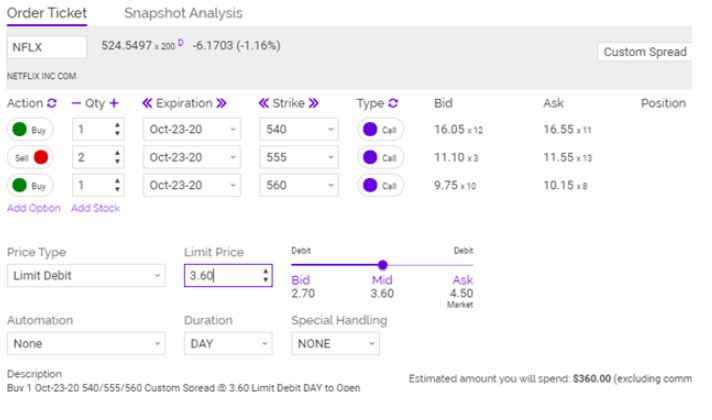

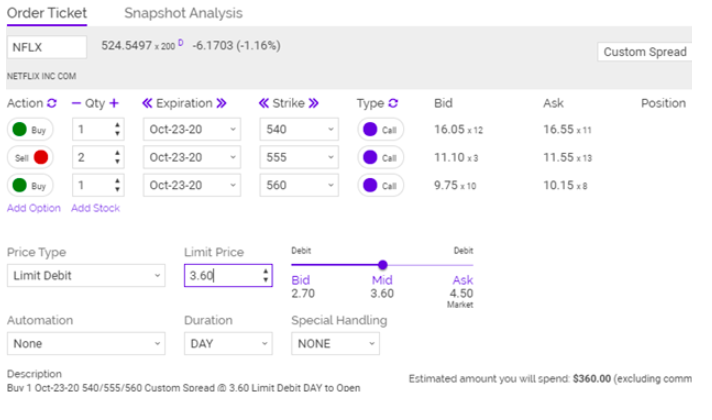

ACTION:

-Buy to open 1 contract Oct (10/23) 540 Calls

-Sell to open 2 contracts Oct (10/23) 555 Calls

-Buy to open 1 contract Oct (10/23) 560 Calls

For a Net Debit of $3.60 (+/-0.15)

Take ADVANTAGE of This Special Offer to the Earnings360 Service!

Here’s what the risk/reward profile looks like. As you can see, there’s potential for a 300% gain if NFLX shares land right at the middle strike of 355 on Friday.

My goal’s a bit more modest, as I’ll look to exit the trade by Wednesday or Thursday for around an $8.00 credit — a 122% profit! Not bad for a couple of days.