A Smart Risk/Reward Trade for the Upcoming Election

By: Steve Smith

The options market continues to brace for the upcoming U.S. election. As the date rapidly approaches, the bold trade is to sell the pumped up premium by assuming that not everything will be burnt to the ground. The elections can be viewed as a market-wide earnings event, or an FDA drug trial announcement due to its specific date — a potentially large price movement catalyst.

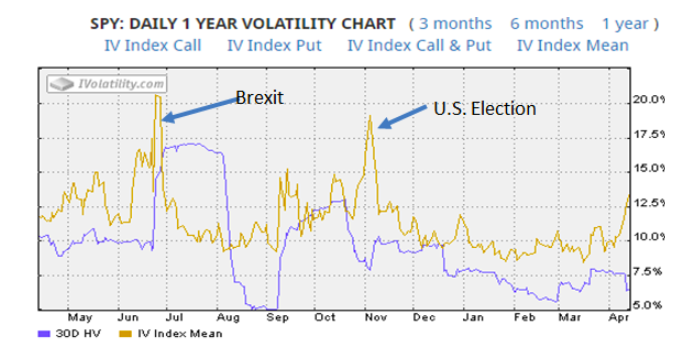

Historically speaking, however, politics has rarely impacted the market beyond a few days. We can view the two biggest surprises in the past five years — Britain’s decision to leave the European Union and Trump’s 2016 presidential victory — to see how the options market pumped up implied volatility only to drop once the events passed. Using SPDR 500 (SPY) options as a proxy for the overall market, one can see that implied volatility (yellow line) spiked higher, leading up to those events, but quickly reverted lower towards realized volatility (blue line).

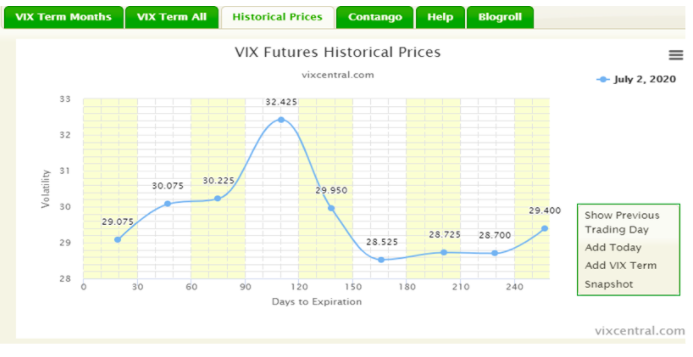

Now, if we look at VIX and its futures contracts, which represents the implied volatility of the SPY across different time frames, we can see an “election hump” was clearly developing several months ago. This VIX term structure image, in early July, shows how the November contract was getting pumped up, but also anticipated a fairly quick drop following the election.

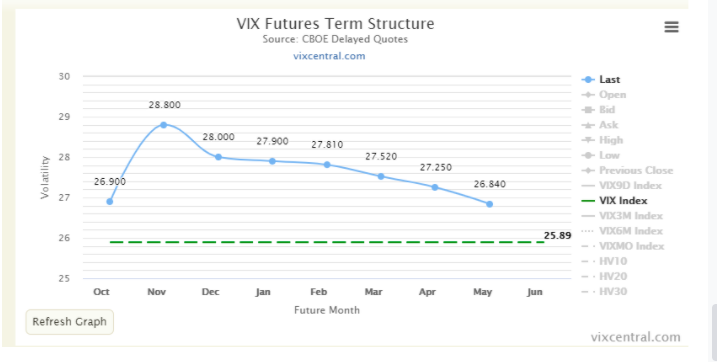

If we fast forward to today, we see the ‘hump’ has shifted to the here-and-now and there’s still an expectation of a decline following the election. It’s also notable that on top of the premium November options to the cash VIX, 28 vs 25, is the huge spread, both have above-realized volatility, which stands at just 16.

LEARN About Our SPECIAL 1-Month $19 Trial Offer to the Options360 Service!

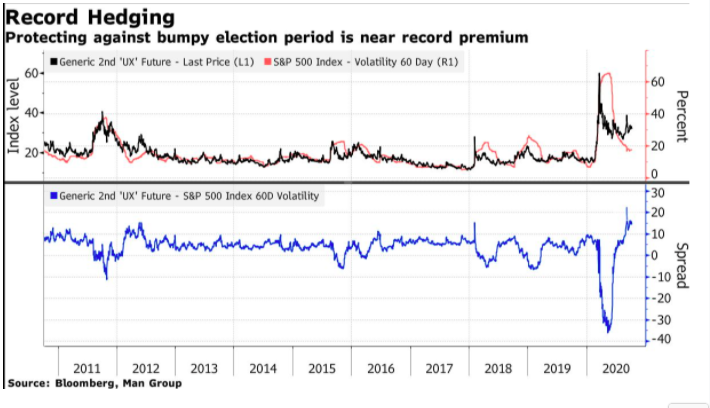

Betting that implied volatility will revert back towards realized volatility could go down in history as the short trade of a lifetime. Yet betting that calm, not chaos, will take hold on Wall Street is proving easier said than done. As one of the most-expensive event risks on record, investors who place a wager on muted stock swings in the Nov. 3 vote aftermath could net riches — if history’s an indicator. But, the prospect of a disputed election is causing even the most seasoned professionals to approach with caution. According to Bloomberg, there’s a record amount of hedging going on, leading to the crazy skew I described above.

For the bold willing to sell or write these protective issues shorting calls in the VIX and its related products can bring windfall gains. But it also comes with unlimited risk in that if things really go off the rails we could see a spike in volatility back to 80 plus pandemic days.

In the Options360 service, we are taking a more conservative approach to buy VIX puts. Specifically, the 22 strike puts which expire on November 25th. They cost just $0.30 per contract and my assumption is if there is a quick reversion and the VIX drops back below 20 following the election these puts could be worth over $2 or an over-500% gain. In buying puts I know my risk is limited to the cost. All in, the volatility landscape offers rich premiums for the brave but I’m taking the safer route which can still offer huge rewards.

[Last Chance] Capitalize on this Exclusive $19 Trial Offer to the Options360 Service!

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

2 Trades I’m Focusing on Amid this Week’s Volatility

November 10, 2020 -

We Have a Winner?

November 9, 2020 -

Why It’s Time for You to Go ‘Long’

November 7, 2020

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.

![[Veterans Day Special] I Want to Say, ‘Thank You’…](https://optionsensei.com/wp-content/uploads/2018/10/shutterstock_415926982-120x120.jpg)