An Important Guide to Trading This Month’s Earnings Season

By: Steve Smith

Earnings season kicks off next week with the big banks such as JP Morgan (JPM), Bank America (BAC), and Goldman Sachs (GS). Also, beginning next week is the 14th installment of my Earnings360 Service in which I provide members approximately 30 trades over a six week period to capitalize on both the price and volatility caused by these quarterly reports.

Even under the best circumstances, earnings can be very tricky to trade as there are many moving and unknown parts. 3 of the most common questions are:

Will the company miss or beat expectations?

What will be the guidance?

Will traders ‘sell the news,’ or buy into the unknown on the belief the recent decline has priced in a near worst-case scenario?

But with COVID creating even more uncertainty, price moves are likely to be even more unpredictable and of greater magnitude. That’s why my Earnings360 Service takes an option-centric approach as opposed to trying to decide whether a company will “meet or miss” expectations.

Because there is one predictable pricing behavior that a savvy options trader can use to produce steady profits. It’s based on the behavior of options implied volatility — both before and after the earnings report. And all the recent volatility and many unknowns means that options premiums will be at record high levels, as market makers need to price options for outsized moves, leading to more profitable opportunities.

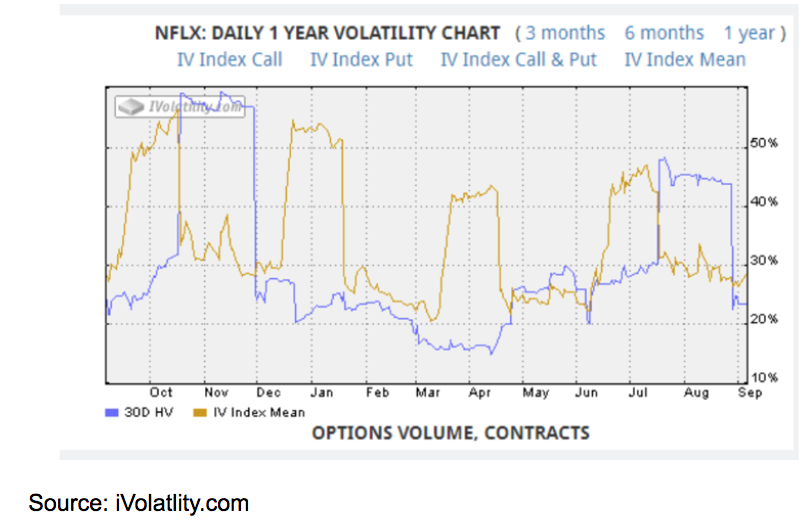

Here’s a quick guide to how I use the Post Earnings Premium Crush (PEPC) to generate consistent profits during an otherwise unpredictable period. The one item we can count on is that no matter what a company reports or how the stock reacts, the options will undergo a Post Earnings Premium Crush — my label for how the implied volatility contracts immediately follow the report no matter what the stock does. Below, notice Netflix’s (NFLX) repeated patterns of implied volatility with options spiking and retreating on the quarterly reports.

You’ll often hear traders cite what percentage move options are “pricing in” the earnings. The quick back-of-the-envelope calculation for gauging the magnitude of the expected move is to add up the at-the-money straddle. This article does a great job of explaining how to use the straddle to both assess expectations and potentially profit.

Once option traders are armed with this bit of knowledge, they advance to using spreads to mitigate PEPC’s impact when looking to make a directional bet. Some graduate to getting this predictable pricing behavior in their favor by selling premium via strangles or, the more sensible limited risk iron condors. There are no guarantees in trading. However, a core tenet of using options is shifting probabilities in your favor. Knowing the best strategies and how to employ them to harness PEPC is one of the most powerful tools for shifting the odds in your favor.

[Last Chance] Register for your FREE Earnings360 Training Session on Wednesday, Oct 7 at 6pm ET before it is too late!

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

2 Trades I’m Focusing on Amid this Week’s Volatility

November 10, 2020 -

We Have a Winner?

November 9, 2020 -

Why It’s Time for You to Go ‘Long’

November 7, 2020

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.

![[Veterans Day Special] I Want to Say, ‘Thank You’…](https://optionsensei.com/wp-content/uploads/2018/10/shutterstock_415926982-120x120.jpg)