How to Profit From Post-Election Volatility

By: Steve Smith

A couple of weeks ago, I wrote how implied volatility was increasing as markets braced for today’s election. However, my expectation was for options premiums to contract, following the event — regardless of the outcome. I previously capitalized on VIX’s expected post-election decline by buying cheap puts on the S&P 500 Short-Term Volatility (VXX) as low risk means to profit.

Today, I’m revealing another beneficial approach for Options360 members that’s straight out of this same thesis — specifically an iron condor in the SPDR 500 Trust (SPY). I’ll get into the trade details below. But first, I want to review the concept and rationale behind the trade. As I mentioned in the prior article, history indicates that politics rarely impact the market beyond a few days.

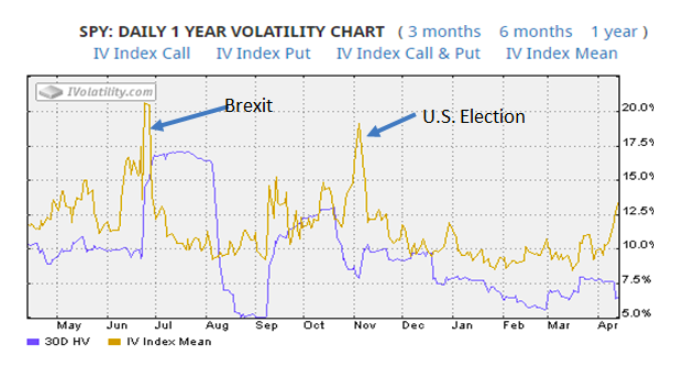

We can view the two biggest surprises in the past five years to see how the options market pumped up implied volatility only to drop once the events passed.:

- Britain’s decision to leave the European Union

- Trump’s 2016 presidential victory

Using the SPY options as a proxy for the overall market, you can see that implied volatility (yellow line) spiked higher, leading up to those events. But, quickly reverted lower towards realized volatility (blue line).

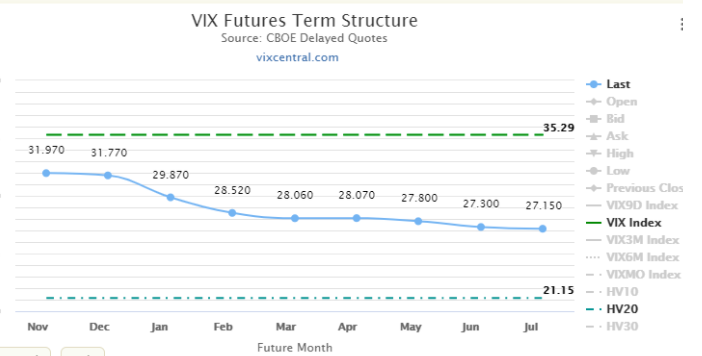

What’s more important to the market, especially in terms of implied volatility, is uncertainty being removed. One could look at the rally over the past few days, which has been accompanied by the VIX declining some 10%, indicating the market already believes there will be a decisive winner rather than a contested outcome. However, even with a decline over the past two days, the VIX ( the green dash at 35.26) stands at extremely elevated levels — especially compared to the 20-day realized (historical) volatility ( lower dash at 21.15). Note: The VIX futures ( blue line in the middle) is trending lower, indicating an expectation that the VIX will drift lower or revert back towards the level of historical volatility over time.

Also, at 34%, the VIX’s nearly double the level it was in the days prior to the 2016 election. Meaning, the market’s pricing at almost a 3.8% move in the SPY through the end of the week. All this equates to a historically-wide spread between what the options market is bracing for and what the probable outcome will be, creating a very rare opportunity to set up an iron condor that has a high probability of success while also offering a great risk-reward.

[Halloween Sale EXTENDED] Capitalize on Our Special $19 Options360 Service Offer!

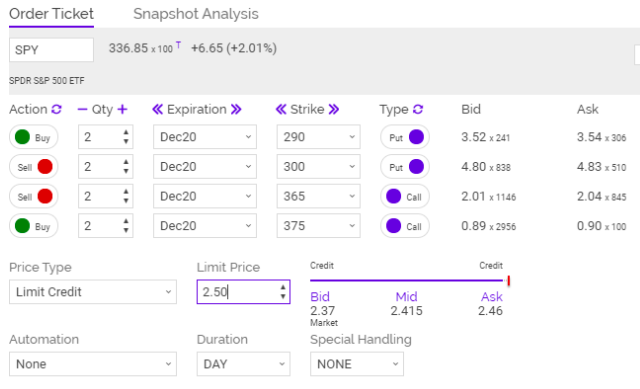

The iron condor I set up for Options360 is in the December expiration and consists of:

-Buy the 290 put, sell the 300 put and sell the 365 calls, buy the 375 call, or a Net credit of $2.50.

An example of the order is below.

The inside strikes of the 300 put and 365 call are nearly 10% out-of-the-money and have a delta of just 11. Meaning, there’s nearly an 89% chance they’ll expire worthless, allowing me to keep the $2.50 premium I collected. But, I don’t plan to hold the position until expiration. My assumption’s that within a week or two, implied volatility will decrease sufficiently to cut the value of the iron condor in half at about $1.25. At that point, I’d close the position for a 50% gain — a fantastic return for a position that has a near 90% probability of success.

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

2 Trades I’m Focusing on Amid this Week’s Volatility

November 10, 2020 -

We Have a Winner?

November 9, 2020 -

Why It’s Time for You to Go ‘Long’

November 7, 2020

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.

![[Veterans Day Special] I Want to Say, ‘Thank You’…](https://optionsensei.com/wp-content/uploads/2018/10/shutterstock_415926982-120x120.jpg)