I Just Initiated a New Trade That Has a High Probability of Generating Profits

By: Steve Smith

On Monday, I initiated a new position I’m calling “the triple roll special” — and no, it has nothing to do with sushi. It’s composed of SPDR 500 Index ETF (SPY) options with the goal of leveraging the fact that SPY has options, which expire Monday, Wednesday, and Friday each week.

In other words, we have the potential to take three or make a triple roll each week.

This allows us to create a diagonal spread position where the long leg has a relatively short time horizon until expiration. But, the strategy still has the potential for multiple rolls, or chances at premium collection, by selling the shorter-dated options with Monday and Wednesday expirations. I will walk you through our current open position in a minute. But first, some background.

Over the past few weeks, I’d been toying with this strategy for my own account as I wanted to become familiar, learn the benefits and identify the risks before bringing it to Options360 Service members. Since the market had been selling off, I was focusing on using puts. After a couple good weeks, I decided it was ready to be a part of the Options360 Service toolbox.

The main challenge of implementing the ‘triple roll’ is that it’s a fairly active approach, and with the recent market volatility, getting alerts to members with accurate and timely prices is crucially important. Twice last week, I began writing Alerts for SPY put diagonals, where we buy options in 10-14 days and take advantage of the Monday, Wednesday, and Friday options by selling and then rolling each to collect premium three times within the one-week period. This ‘triple roll’ benefits from accelerated time decay of the short-term options, and brings in income, and rapidly reduces the position cost basis. However, each time SPY gave up the gains in a blink and the attraction evaporated.

Finally, this Monday morning, I sensed that the market was getting oversold so I decided to focus on the call side of the equation. I sent an Alert initiating a position with the purchase of the March (3/19) 383 call while simultaneously selling the March (3/08) 384 call for a net debit of $3.30 for the spread.

Note: The call we sold was actually set to expire that same day. So, that afternoon, we took the first of our rolls by buying to close the Monday (3/08) 384 call and selling to open the Wednesday 385 call for a net credit of 0.65. The new position is now long the March (3/19) 383 call and short the March (3/10) 385 call at a $2.65 cost basis.

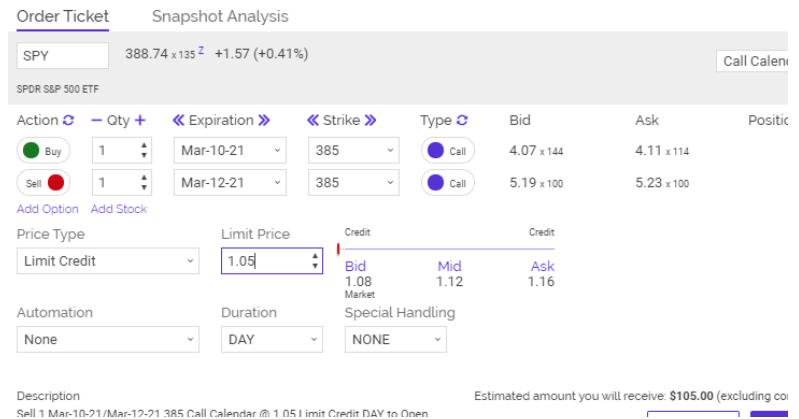

Now, we’re getting ready to take our third roll by buying to close today’s 385 call and selling to open Friday’s (3/12) 385 call, and collecting another $1.05 of call option premium.

Here’s the image of the order ticket which was sent with the Alert at midday.

Through three sales of this week’s Monday, Wednesday, and Friday options, we have collected a total of $1.95 premium, bringing the cost basis of our diagonal spread down to just $1.60. And the beautiful part is that we still have next Monday and Wednesday to execute two more rolls against the March (3/19) 383 call that we own. Based on the premiums we collected this week, I expect this to become a ‘free’ trade by next Wednesday; meaning we will own the March (3/19) 383 call for a zero-cost basis with days remaining until it expires. That gives this position a very high probability of generating a profit.

It’s also likely I’ll initiate a new SPY position by Friday or next Monday. Although it will be separate, it will run simultaneously as the one above. This way, as the current position winds down, we’ll be engaging in a new round of ‘triple rolls’ to keep the income stream going.