How I Beat the S&P 500 by 319% In Q1 2021

By: Steve Smith

Q1 2021 is officially in the books with the Options360 Service doing what it’s always done; delivering consistent, market-beating returns without assuming undue risk.

As of March 31, Options360 is up 24.2% in just the past 3 months, beating out the S&P 500 Index’s gain of 5.77%, despite it reaching all-time highs. And the Nasdaq, which had soared by 45% in 2020, is up 2.78% as of yesterday. This sets the stage for Options360 to not only maintain its streak of beating the major benchmarks to deliver another year of 40%-80% annual returns in 2021.

Since 2015, Options360 has continued to deliver superior returns; +113% in 2015, +63% in 2016, +51% in 2017, +67% in 2018, +77% in 2019, +47% in 2020> Get this special offer of a quarter for $147….

A really nice aspect of Options360 is consistency. My respective approach allows us to avoid big swings without suffering large drawdowns, aka being dragged into a euphoric state of mind via chasing unsustainable gains.

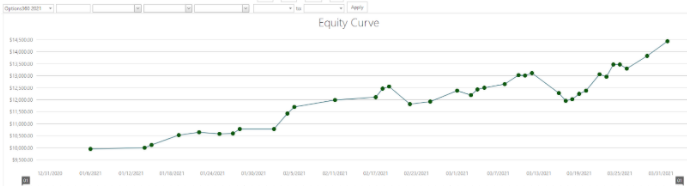

Check out this incredible YTD equity curve for the Options360!

That’s not to say there hasn’t been crazy market moves and news. Taking a page from the college basketball sports world, it’s been sheer “madness!” The overriding global macro influences of the pandemic to investment-focused trends, such as growth-to-value rotation. But that’s not all. Who can forget the head-scratching action of Gamestop (GME) and AMC (AMC) stocks on Reddit’s r/WallStreetBets thread as well the very-specific “inside baseball” blow-ups of various hedge funds which reminded us that “the smart money” could be anything but “smart” — especially if they have too much of it.

So, how’d we navigate the above noise and where will we steer our trades going forward? As always, the trades are constructed to have a defined risk/reward. That’s accomplished by using spreads, making cost-basis reducing adjustments, and setting price targets for securing profits and minimizing gains. That discipline and guiding principles will not change.

Before diving into where we go from here, let’s take a look at some basic stats:

Number of positions closed: 22 [about 7 per month]

Winning percentage: 68%

Average Profit: 48%

Average Loss: 32%

Strategies Used: Diagonal Spread 8x, Credit Spread 5x, Iron Condor 4x, Vertical Spread 3x, Ratio Spread 2x, Butterfly Spread 1x.

In addition to maintaining a disciplined approach, the catalyst for driving performance was identifying the rotation out of tech growth and into more cyclical names. Our bullish positions in Morgan Stanley (MS), Mosaic (MOS), Pulte Homes (PHM), all initiated in late January or February, each delivered 50%-plus profits over a 3-5 week holding period. An early-March Costco (COST) move, after the big box winners had been beaten down, provided a quick 65% return in a mere three-day holding period!

Q1’s worst trade was iShares 20+ Year Treasury (TLT) as bet interest rates would cease to rise. The bullish position I set up in TLT on January 12 when the 10-Year Note yield hit 1.35% — up from 0.70% just two weeks prior — was down 50% in a matter of days. Rates kept rising. As much as scrambled-to-stem the damage was, the position expired on March 16 with a 88% loss. Ouch! That’s why I try not to let my opinions influence my ‘price is reality’ approach to trading.

Even though I’m not a huge college sports fan, the NCAA’s Final Four of March Madness will certainly have my attention. Players’ and fans’ enthusiasm aside, I do love the tournament’s nature in how it consistently produces a compelling Cinderella story and a toppling of a goliath with every game being in a must-win format.

However, what really fascinates me is brackets. Or more specifically, the money and approaches playing the brackets. With trading in my genes, this is where I can spot real analogies to options trading. I know many of you are now groaning, “Oh Steve, are you really going to stretch out some really bad analogy?” And you’re right. So I’ll do you the liberty of keeping it brief.

Start with Warren Buffet’s annual bracket bet in which stakes $1 billion for anyone who can create a perfect bracket. In other words, calling the winner in all 48 March Madness games. Statistically speaking, that’s a 9.2 quintillion to one shot.

Buffet’s been running this challenge for over seven years and while some lesser hurdles have been met, such as getting the first and second round right, or having the correct final four or even the ultimate winner, no one has ever produced a perfect bracket.

The lesson is; there will indeed be losses on the path to ultimate success.

The best bracketologists use a combination of statistics with some qualitative judgments to find the right balance of favorites who have a high probability of making it into the later rounds. Of course, long shot teams are also included, and if they burst into the Sweet 16 give investors a very attractive risk/reward scenario heading into the final rounds.

I don’t know much about it, but apparently, one holding a long shot team can find a myriad of ways to hedge, or actually lock in a profit, heading into the Final Four games.

Now that’s the position I’m always looking to be in; locked in profit but still in the game for additional upside. Sit back and enjoy the action!

[Q2 Sale Offer] Grab your spot in the Options360 Service for the discounted 3-month price of $147!