Why I Expect a 72% Return in a Trade I Just Initiated Today

By: Steve Smith

Yesterday, I invited you to join my Options360 Service to listen in on this afternoon’s Webinar where I’ll go through my current watchlist and discuss: The strategies I use, what I look for in a trade, why I make the trades I do, and most importantly, which stock I’m currently watching.

It’s not too late to join today’s call, and also gain access to the hundreds of hours of webinars in the Options360 archive for the special offer price of just $19!

While I’ll be going through my on-the-radar stocks and technique on approaching establishing positions ala my patience waiting for entry points. However, I would like to share one trade that triggered today that I expect a 72% return on — over the next three weeks. And that’s if the stock does absolutely nothing but hold it’s ground over that respective time period.

The stock is C3.ai (AI), a recent IPO (12/20) that came to market with great fanfare, tripling from its offering $60 price, and immediately started flaming out — losing more than half its value in the ensuing months.

People liked that it hit the market at the peak of speculative growth frenzy. It offers a pure-play on artificial intelligence and comes with a blue-chip pedigree of management led by Siebel Systems founder and legendary Silicon Valley pioneer, Tom Siebel.

What’s not to like? Despite its 50% decline, it still sells at 20x revenue with a very high customer concentration as 10 major corporations account for over 50% of sales. The business model depends on adding more Fortune 500 corporate clients as de facto distributors in order to create a SAAS model.

It also fell victim to the general sell-off of high growth tech stocks during the February/March rotation and rise in rates.

Items on the fence are shares that are fairly tightly held by insiders and institutions while there’s also high short interest, some 20% of float, creating at least a potential floor in the shares, if not a squeeze.

Gain Access to the Information you Need to Keep Yourself Safer and Profitable for just $19

The chart below shows that the stock held the $60 IPO price and is now clearing the $70 resistance level.

Implied volatility of the options is near 80%, or in the 65% percentile — relatively high considering the recent price action stabilization, and that earnings aren’t until mid-June.

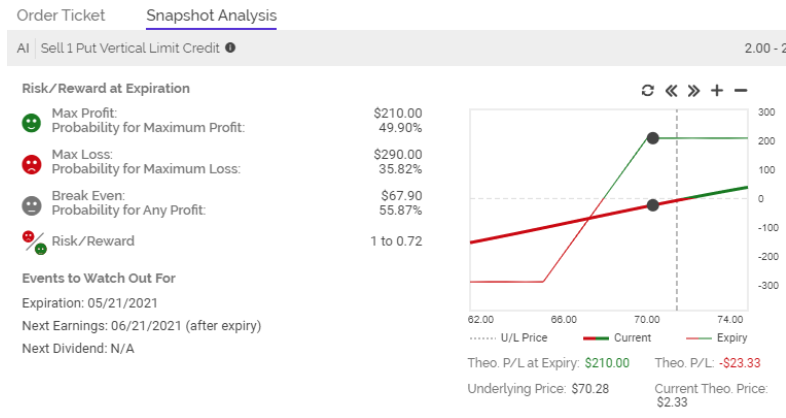

A bull put spread looks attractive. Specifically:

-Buy to open 1 contract May (5/21) 65 Put

-Sell to open 1 contract May (5/21)70 Put

For a Net Credit of $2.10 (+/-0.10)

As you can see from the risk/reward graph below, the maximum profit of the premium of $2.10 collected is realized as long shares of AI are above $70 per share at the May 21 expiration. That means we can earn a 72% return on risk, even if the stock does nothing for the next three weeks. In fact, shares can actually decline slightly and we’d still earn a profit. This is the power of theta or time decay.