Why Size Matters (In Trading)

By: Steve Smith

Today will be a quick one as I’m sussing out the ways to play Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL) which all report after the close today.

As mentioned over the past two weeks, I had turned cautious on stocks, even as the indices pushed to new highs. I explained why I established a bearish position on Friday in Invesco PowerShares (QQQ), using the Monday, Wednesday options to execute rolls to reduce cost basis. My reasoning was because even if the stocks mentioned above post blow-out numbers, they could be met with a “sell the news” reaction. Well, like most things in this modern world, everything happens faster. So, is today’s sell-off occurring without even waiting for the news?

Whatever the reason, we have now executed two rolls bringing the cost basis of the position from $440 to $120, with the opportunity for two more rolls.

However, I’d really like to respond to the following reader question: “You’re always touting 50% or more profits on the trade, so why is your service up only 24% for the year?”

First, let’s be clear, I also divulge my losers such as here in Mosaic (MOS), Pulte Homes (PHM), and Pure Cannabis ETF (MSOS).

Second, 24% is nothing to sneeze at.

The key to having consistent profits is managing risk. This starts with identifying good risk-reward entry points. But, of equal if not more important, is position sizing. The basic rule of thumb is that no one position should be over 5% of your total portfolio.

Options360 resets the account $10,000 each year. This is an amount that should allow most people to partake. If you have a larger account or higher risk threshold, that’s good for you. I’d rather people dial up their size than intimidate or prevent participation by staying. Options360 runs a $1 million account and they say “oh, that’s not for me.”

The bottom line: You want more winners than losers, and the profits from those winners to be larger than the losses.

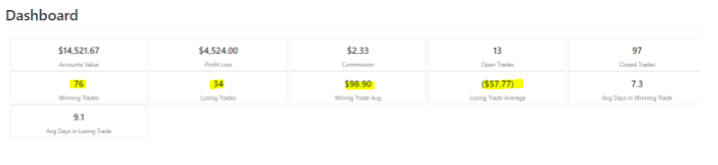

Here are the stats for Option360 trading service over the past year and a half.

In 2020. we at Options360 executed 97 trades, 76 winners, and 34 losers. Profits averaged $98 while losses averaged $57. That’s basically, twice as many winners as losers for twice as much profit.

The statistics are pretty similar for 2021 thus far:

So, while absolute numbers of just $100-$200 on each trade may seem pedestrian compared to people boasting about making $987,645.10, I’m being realistic.

Realistic, transparent, and consistent. These “small” numbers add up to the Options360 trading service returning 39%-120% over the past six years.

I keep my size small, so I can stay in business and continue marching up and to the right.