Why I Believe the Market is Overdue for a Correction

By: Steve Smith

Coming into yesterday morning, there was a triumvirate of news. There’s a growing consensus that the Fed will begin tapering by October, as the delta variant starts taking a toll on economic activity, i.e. travel/leisure, and geopolitical events. Many people fear that the Afghanistan debacle will open the door for China to exert more aggressive measures across Asia, especially in Taiwan, which would weigh heavily on the stock market. Yet, the major indices opened just fractionally lower.

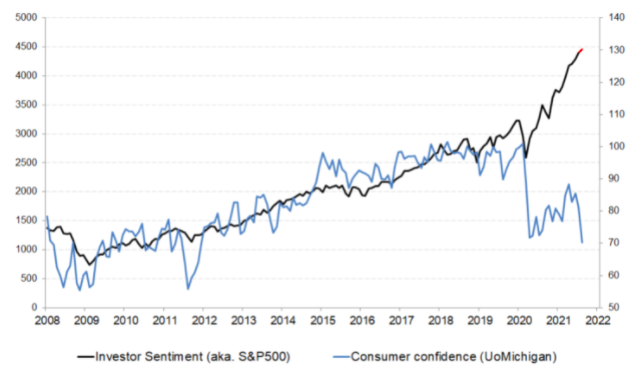

Yes, they did decline more as the day wore on, returning to Monday’s lows today. However, that’s still just 1.2% off all-time highs. It looks like we’re back to a growing disconnect between Wall Street and Main Street.

According to various surveys such as Investor Intelligence stocks, the bulls continue outweighing the bears by about a 2:1 margin for their stock outlook over the next 6 months.

Meanwhile, consumer confidence has tanked back below the April 2020 pandemic low, standing at its lowest level in nearly a decade.

Yet, the stock market keeps pushing to new highs. One of the many amazing statistics produced over the past two years comes out of the S&P 500 Index (SPY), which has hit 119 new “all-time highs.” The new highs in the prior 18 years were 13; four of which occurred in 2000 just prior to the dot.com bust and 9 in 2007 leading into the financial crisis. Hmmm.

However, before I return to my cautious stance, I must note a few crucial differences between those occurrences and the current situation. First, the 2020 “recession” was somewhat artificially caused by self-induced lockdowns rather than broad economic distress — allowing many consumers to stay in a solid, or improve their financial income state, savings rate, and net worth so that spending can remain robust and re-accelerate into the fall. And, the tapering simply means the Fed will reduce the amount of monthly liquidity it’s injecting; removal of quantitative easing is still a year-plus away. Actually, rising interest rates might be two years away. Meaning, the system’s still awash in cheap money and asset prices can remain elevated.

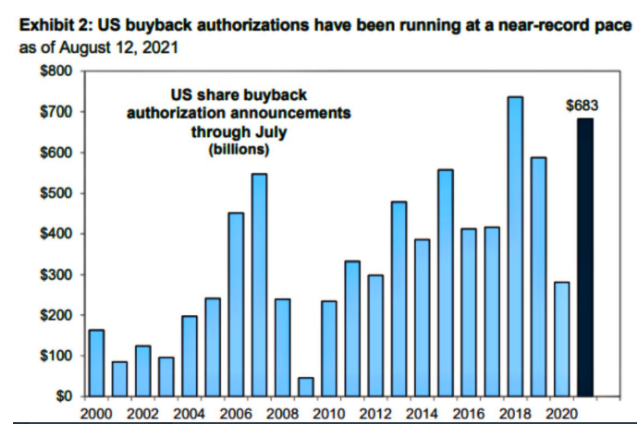

Another aspect is corporate earnings — along with their balance sheets — being strong. This allows a buyback resurgence and creates an additional support layer.

The bottom line is that several people, myself included, think the market’s overdue, and deserves to have a 10%-15% correction. My Options360 Concierge Trading Service is maintaining some downside protective puts, even though money flow, bullish sentiment, and corporate profits remain the overriding bullish forces. This results in every 3%-4% decline being perceived as a “buy the dip” opportunity.

[LAST OFFER] Test drive my Options360 Concierge Trading Service for only $19!