You Missed This Trade, Don’t Miss Another One…

By: Steve Smith

On one trade!

Here was the alert I sent:

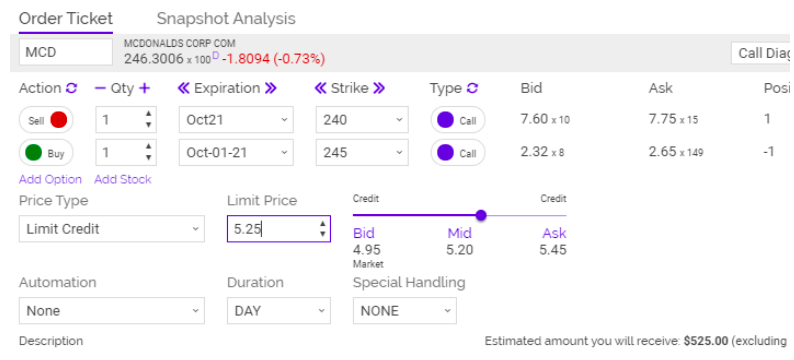

1. MCD current position is a bull diagonal of long 1 contract Oct (10/15) 240 Call and short 1 contract Oct (10/01) 245 Call at a $2.30 cost basis

Stock is holding up nicely. But it is already through our upper strike. Let’s book solid profit.

ACTION:

-Buy to close 1 contract Oct (10/01) 245 Call

-Sell to Close 1 contract Oct (10/15) 240 Call

For a Net Credit of $5.25 (+/-0.15)

Solid profit is right!

And now with the sell-off yesterday, I am tracking some very promising trades for later this week or early next week.

Don’t miss out on them!

Click here and grab your first month of Options360 for just $19.

To Your Success,

Steve

PS. This volatility could mean some big profits in the short to mid-term time frame. But you need to be ready when the opportunity arises.

Click here and make sure you’re ready to grab your share of the profits.