Why It’s Important to Maintain the Flexibility to Make Adjustments

By: Steve Smith

Yesterday, I discussed how I was building a shopping list of tech names that I thought would be great buying opportunities; it included three names, BigCommerce (BIDC), Unity (U), and Palantir (PLNTR). Thankfully, I held off doing anything in any of those yet as they, along with the major indices, especially the etch heavy Power Shares Nasdaq 100 (QQQ), which continue to come under selling pressure.

To be perfectly honest, I was surprised by the weakness in yesterday’s close. What had been solid green across my screen swiftly turned to red. I guess the selling is not complete, nor was the recent flush violent enough to create a short-term bottom, let alone the infamous dead cat bounce. The QQQ is now firmly back in correction territory, down some 11% for the year date.

Unfortunately, Options360 dipped a toe into a PayPal (PYPL) bullish position for whom I thought the selling was played out and was set to hold the old support from the summer of 2020 at the $170 level. No dice, the stock closed low yesterday and gapped lower today; forcing me into a defensive adjustment. I quickly cut our risk in half, to about $250, and still have some hope we get a rebound next week.

But, this speaks to how important it is to be patient for good setups, and maintain the flexibility to make adjustments quickly and decisively; even if that means closing the position.

Maybe I became spoiled during the first few weeks of 2022 as Options360 ran off 5 straight winners, all returning over 45% within 48 hours. Losses and drawdowns are inevitable. It’s how you manage them that matters. Even if PYPL becomes a 100% loss it will represent less than 2% of the portfolio. This is far from devastating.

On a more optimistic note, today actually bolsters my belief that we’re heading for a tradable low. Maybe a low within a longer-term downtrend. However, I’m once again looking for some buying opportunities.

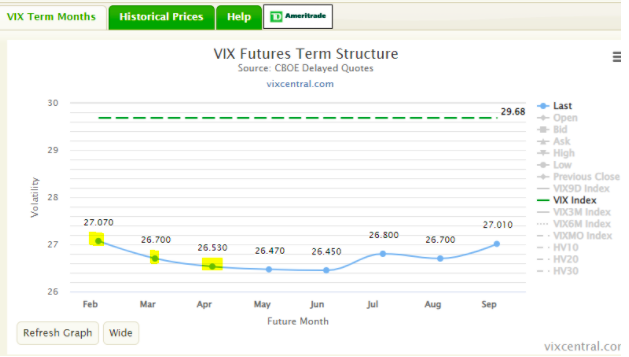

Three of the items informing this view is that the VIX term structure finally went into backwardation. Meaning, the front-month options trade as a premium to the later date. It’s not steep. However, it does suggest that people are starting to scramble for protection here and now. Not quite a panic. But, the first step is finding some real fear.

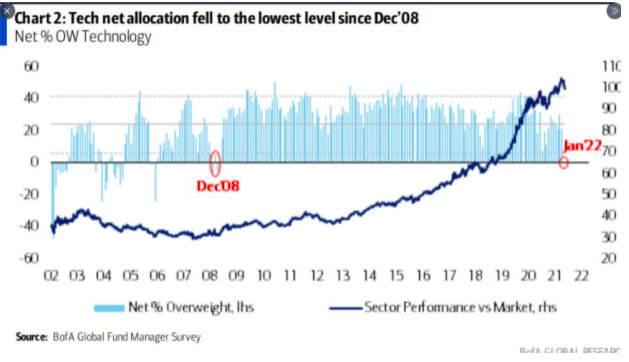

Second, the allocation to tech has dropped to its lowest level since the 2008 financial crisis. Granted, tech is a much larger sector than it was 14 years ago. However, it represents a significant sentiment shift. Namely, not all companies will grow to the sky.

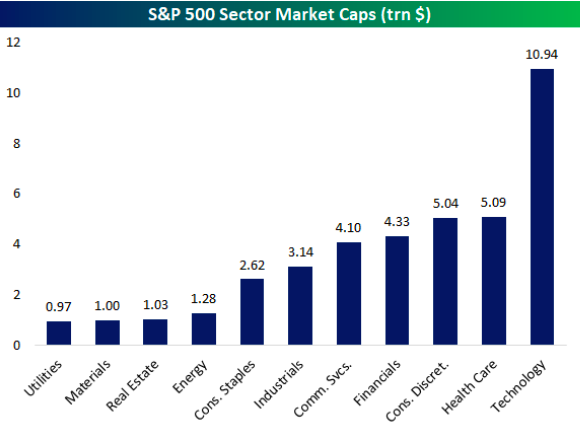

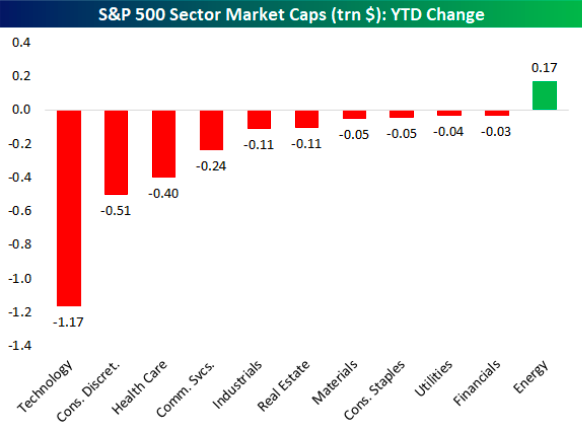

To give an idea of just how large and important the tech sector has become to the market, here’s an image of weighted market cap by sector. Tech has lost over $1 trillion in just the past 16 trading days. Yet, it still stands head and shoulders over the next three sectors combined!

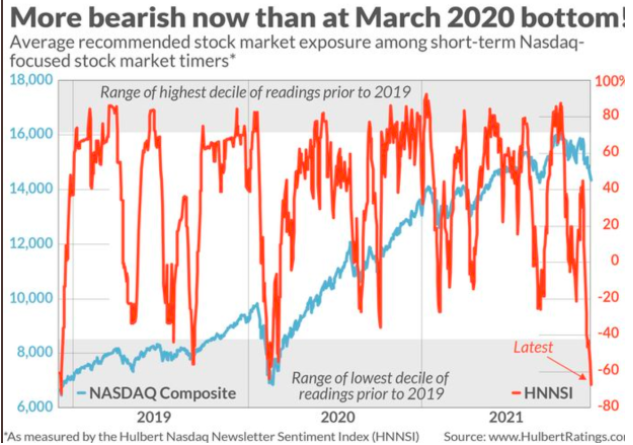

Lastly, sentiment for the Nasdaq/Tech is now more bearish than it was during the 2000 dot.com bust!

I was there during the dot.com daze, and yes I was a HIMI even back then and aside from some ‘premature’ shorts, never got involved in the insane names.

This is not the same. The stocks, SPACs, $50 billion IPOs for profitless companies have already crashed. The speculative bubble has popped.

Now, we can begin to sift through the wreckage. Patiently and carefully.