Using Credit Spreads to Profit Amidst the Volatility

By: Steve Smith

Since the S&P 500 futures’ inception 40 years ago, there have been only 3 sessions when they opened down over 2%, fell to a 6-month low, then rallied to close up by over 1%. This occurred on July 24, 2002, September 16, 2008, and yesterday. The Nasdaq 100 was down over 3% prior to closing up 3%; the largest daily range since May 2020.

Again, this whiplash action begs the following question: Are stocks trying to find a low, or are the violent rallies simply snapbacks from oversold conditions within a longer-term downtrend.

In these pages, my opinion may seemingly oscillates depending on price — which it does to a certain extent — as each day brings in new data that needs to be incorporated into your thesis to maintain a flexible mind frame. But, my overriding theme has been that the market will make a new low in the coming months.

That said, I continue to make some tactically bullish trades, whether it was buying the SPDR S&P 500 (SPY) “whoosh” down on January 25th, or earlier this week stating the Ukraine invasion was setting up a “buy at the sound of cannons” moment. I closed that article by saying “If history is any guide, one should start scaling into long positions, especially in consumer discretionary, travel, and leisure.”

The Options360 Concierge Trading Service added a few bullish positions by using put credit spreads. A put credit spread involves buying a lower strike put and selling a closer-to-the-money put for a credit. The profit’s limited to the premium amount that you collect, with the risk being limited to the width between strikes minus the premium collected.

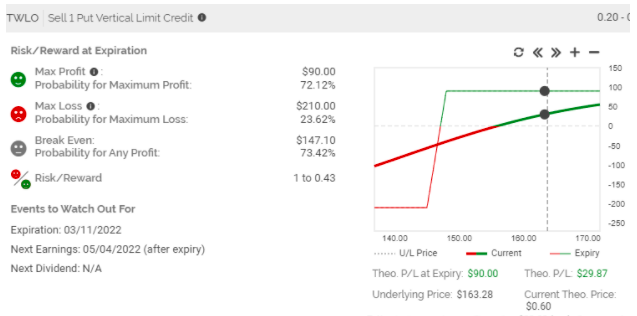

Here’s a risk/reward profile example for a bull put spread in Twilio (TWLO) that Options360 established yesterday.

The main advantage of using a credit spread is that one can still profit even if the stock moves slightly against you. In this example, Options360 members can collect the full $90 per contract spread even if TWLO shares drop from their current $160 down to the $147 level of the strike we sold short. In the currently volatile markets where price swings move further than one might anticipate, the credit spread provides a nice cushion to profit without having to get price levels or even direction exactly right. This also speaks to the other reason I’ve been choosing credit spreads, implied volatility is elevated, meaning we are collecting juicy premiums.

The main disadvantage of credit spreads is that they usually have a risk/reward profile with potential loss larger than the potential profit. In the TWLO example above, the max profit is $90 while the max loss is $210 per spread. But, you’ll notice that the probability of this position achieving a profit is 72%; the trade-off is lower profit potential but higher success probability. The extra premium offered by high implied volatility is what tilts the odds in favor of an attractive risk profile.

Options360 has also established a couple of bear call spreads for credits; specifically one on Gold (GLD), which had a huge reversal yesterday. Again, the credit spread leverages high premiums and provides a cushion to withstand some wild price swings.

One rule that I’ll leave you with: I never hold a credit spread until expiration. Once 60%-70% of the maximum profit is achieved, I close it. Trying to squeeze out the last nickel or dime turns the risk/reward unacceptably asymmetric. With all the headline risk out there, holding until expiration is truly picking up pennies afront a steamroller.