Revealed: An Earnings Trading Strategy That Delivers Consistent Returns

By: Steve Smith

On Tuesday, I hosted a webinar explaining my Earnings360 approach to trading during earnings season. I also executed a live trade, to display how I harness implied volatility behavior to generate consistent profits from these often-chaotic events. The first trade recommendations will be issued this coming Monday, April 18th with the program running for six weeks.

Access Your FREE Webinar Video Here

I described how we use the Post Earnings Premium Crush to produce 80% to 150% gains on earnings trades. However, while PEPC provides an edge, there’s still some risk of the stock moving more than expected, or in a different direction.

Today, I want to look at a strategy Earnings360 employs that deliver consistent returns over a four-day period without actually holding the position through the report. I refer to this as “Pre-Earnings Premium Expansion” (PEPE).

In 16-plus quarters, Earnings360 has executed 89 PEPE trades, achieving a win rate of 81% with an average gain of 27%.

This strategy leverages the implied volatility increase that precedes earnings; avoiding the actual event altogether. Just as PEPC is predictable, so is the pumping up of premium leading into the event; the basis for PEPE trades.

PEPE occurs incrementally over many days; making it more subtle than PEPC. Here, you can see Schwab’s (SCHW) implied volatility climb in the days leading up to the earnings release before reverting lower after the report.

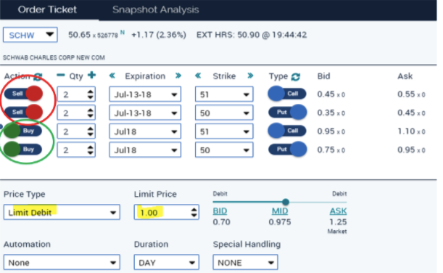

A strategy for leveraging rising IV, leading into earnings is a calendar spread. This is where you sell an option that expires prior to earnings while simultaneously purchasing one expiring after the event. Here, you can see the SCHW order that Earnings360 placed where we sold the weekly puts and calls that precede the earnings report while buying the following week, which contains the report.

Like any calendar spread, it benefits from the accelerated decay of the nearer-dated options sold short. However, this has the added tailwind of when earnings approaches the option. There will be a rise resulting in a spread value increase. To keep the position delta neutral, both the put and call calendars should be established.

These positions must be established in advance and closed before the actual earnings. The profits might not be as dramatic as catching a huge post-earnings move, but they can be substantial. More importantly, they can be consistent and have a high probability.

All told, it has executed 89 PEPE trades, achieving a win rate of 81% with an average gain of 27%.

With weekly options, there should be a plethora of situations in the weeks ahead to leverage IV rise, leading into earnings, by using the PEPE double calendar strategy to produce consistent 30% returns — without taking the risk of holding the position through the earnings report.