REVEALED: Why ‘Revenge Trading’ Is a Really Bad Idea

By: Steve Smith

Yesterday, I made a gut call that the market could reverse the morning’s sell-off. And indeed it did as the Dow moved over 500 points from its respective low. What a great call! Guess how much money I made? None. Why didn’t I make a trade or make any money?

Although I consider myself a good “tape reader,” I don’t like letting my gut do the trading.

So while yesterday I had a good sense of the market action, I didn’t have a specific setup with defined levels for targets and risk management. Hence, no trade. I simply watched with growing frustration as the indices enjoyed one of their best rallies in weeks.

But, I’ve been there before; there are always things you “coulda, shoulda, woulda” done. My cure for that syndrome is simply getting back to work. So last night, I expanded my watch list from its typical 50-plus names to about 100. I also spent an extra hour going through the charts.

The most attractive set-up I found was a bearish stance in Tesla (TSLA). I haven’t traded TSLA in years and I swore off ever trying to short it; exactly why this was a fairly-high conviction call for me to make.

Of course, I wanted to share it with my Options360 Concierge Trading Service members. I sent an Alert right before the market opened that stated:

“What we have here is I believe a good technical setup for a bearish trade in the stock

It left a gap back in early April which barely got filled following last week’s earnings report and is now having trouble holding the important $1,000 level.

[Special Trial Offer] Click Here to Learn How to Trade Options for High Returns for Just $19!

I think the stock could drop back down towards the $930-$940 level in short order.

Let’s use a short-term vertical put spread.”

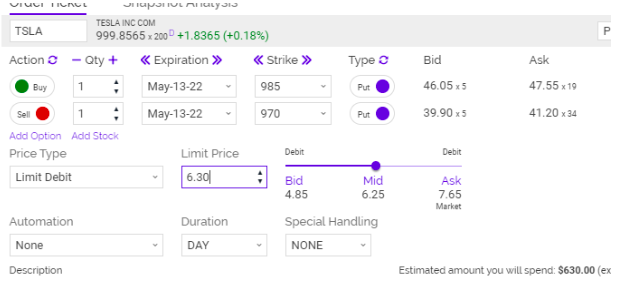

Our order was the mid-point of the bid/ask and I gave the discretion to go $0.30 higher.

Something frustrating about options, especially spread, is the bid/ask can be very wide, particularly on the opening, even in a liquid name such as TSLA. Note in the image of the order ticket above the bid is $4.85 while the ask is $7.65; that’s over a 25% wide span from the mid-point.

Needless to say, the order didn’t get executed at the opening and TSLA tumbled almost immediately; down by 7% to $940 within the first 30 minutes. As of noon today, shares were down as much as $100 to $900.

I tell this tale not to somehow show I “almost” made a great trade, that would be worth as much as we made (nothing).

Instead, it’s what I did (and didn’t do) next to that hopefully offers a valuable lesson. After missing the trade, I randomly punched up charts with no regard to my watch list or my last night’s notes. I searched for a trade to make the money I felt I should have aka “revenge trading.” It can occur after a missed opportunity or following a loss.

Revenge trading is bad! Your rules, discipline, and risk management get thrown out the window.

Once I caught myself in this revenge mindset, I literally stepped outside and took a 15-minute walk. When I returned to my desk I methodically scoured my watch list. I didn’t see any compelling set-ups. But, rather than feeling anxious over needing to make a trade, I was at peace merely being patient.

Now, having written this article it’s fully out of my system. Thank you for listening. Time to look at some earning plays for this afternoon.