REVEALED: How to Profit Using Implied Volatility

By: Steve Smith

The term volatility gets thrown around a lot, often used interchangeably for big price moves, especially with perceived risk.

But for options traders, volatility, or more specifically implied volatility has a very defined meaning and is crucial to understanding the probability of profitable trading.

On Monday, the CBOE S&P 500 Volatility Index (VIX) crossed above the 35% level as Options360 established a put spread on the notion that implied volatility will drop back below 28% within the next two weeks.

Having made that trade in the VIX, I thought it would be helpful to cover what implied volatility means.

I often use the analogy that you don’t need to be able to build an engine to drive a car, just know the gas from the brake. However, a rudimentary understanding of how the parts work and are connected helps you avoid accidents and enhance performance.

Likewise, you don’t need to get all geeked out on the Black-Scholes model to trade options. However, a basic understanding of options pricing and behavior under a variety of conditions will go a long way to successful trading.

Implied volatility is a “plug number” (a placeholder for an accurate calculation estimate) used to make the result from the commonly-used apparatus for valuing options (Black-Scholes model), which considers 5 factors when calculating an option’s theoretical fair value:

- The price of the underlying security

- The strike price.

- The time, or expiration date of the option

- Interest rates * this is becoming increasingly important in the rising rate environment and with upcoming FOMC meetings.

- Implied volatility.

The first four inputs are known variables. To get number five, we plug those four inputs into the Black-Scholes model; giving us “theoretical” implied volatility This helps us decide whether an option is cheap or expensive.

But, given that options trade regularly, there is an “actual” implied volatility assigned to each option based on its price, which constantly updates in real-time.

There are two features of implied volatility that tend to be poorly understood. First, it’s a derived number and second, it’s expressed in annualized terms.

So, what does the actual or real-time implied volatility tell us? This is where we get into the weeds of math and probabilities.

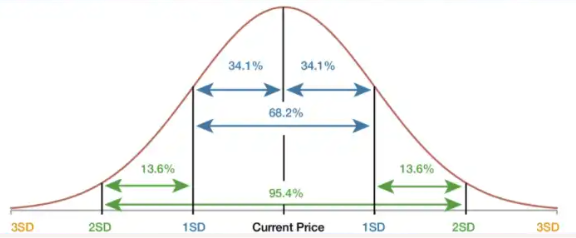

- IV is a proxy for standard deviation.

- Price should remain within 1 standard deviation 68% of the time during the course of a year.

To get this into a manageable form, particularly for short-term options, we want to translate this into a daily time frame.

This brings us to the ‘rule of 16’ where you take the square root of the 256, the number of trading days in a year or 16, to calculate the expected daily move.

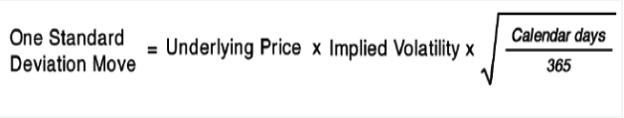

For the math geeks out there, this is the formula:

Hence;

- A 25% implied volatility on a $100 stock should remain within $75-$125 for 68% of the time.

- Applying the rule of 16 (25/16) translates into an expected 1.56% daily price move.

When the VIX currently hit 35% yesterday it was suggesting the SPY would move 1.18% on a daily basis.

Understanding implied volatility will help your buying or selling options decision-making and make you a more profitable trader.