The “3 Ps” Of Options360

By: Steve Smith

My trading career started in the “pits” of the Chicago Board of Options Exchange, where I worked as a market maker.

That was more than two decades ago.

Since those first days, I’ve lived a lot… learned a lot… lost a lot… and won a lot…

And today, I have more than 20 years of trading success under my belt.

When you’ve been trading as long as I have, you eventually get asked how one becomes a successful trader. And since it’s a question I find myself having to answer frequently these days, I’ve summarized the most important lessons into three easy-to-digest points.

I call them “The Three P’s” — or 3Ps for short.

I invite you to join Options360 for a full 30 days for just $19

The Three P’s

But before we get to my 3Ps, there’s one P we want to avoid at all costs…

…making Predictions.

In trading, there are external forces we cannot control. How many people predicted that crude oil would fall from $60 to below $30 a barrel in 2020? And once it got there… how many people correctly predicted that it would turn negative!? And now we find ourselves back above $100 per barrel.

Yes, trading would be easy if we had a crystal ball telling us exactly how the future will unfold. But successful trading is not about making good predictions. It’s about making good decisions.

The First P: Process

While I’m always interested in the fundamentals and basic business of a company, my process for identifying trades starts with charts. As a certified technical analyst, I use charts as my starting point. Using technical analysis allows me to identify which stocks have momentum, where support and resistance levels are, and what targets have an attractive risk/reward.

I try to keep it fairly simple using basic trendlines, moving averages, and highs and lows. I go through a logical sequence to get a good technical picture of the underlying target:

- What is the overall trend of the underlying?

- What are the immediate points of support and resistance?

- Is the trend more likely to continue, or is it poised to reverse?

- Regardless of our analysis, what are the next logical price targets?

- What indicators are available to us to verify our expected price behavior?

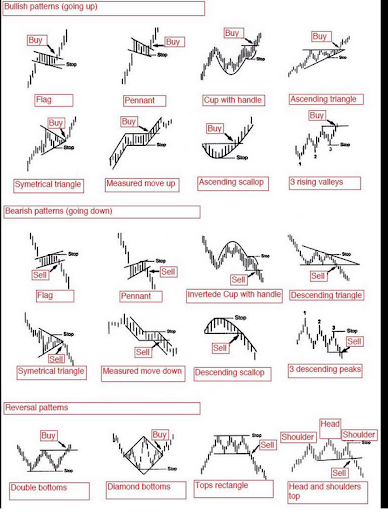

Here are some common patterns to be aware of as a trader:

The Second P: Profit

The next step is identifying which option strategy offers the best profit, assuming my thesis plays out. Do I expect a large move in a short time period? If so, I might use the full leverage of buying short-term calls out right. Do I expect a trend to continue over the next few months? In that case, I might choose a spread with 60 days or more until expiration. I frequently use a calendar spread to marry these two approaches.

The goal is to choose the strategy that offers the best risk/reward AND aligns with my investment thesis in terms of time and price.

Creating the right risk/reward means not needing to write all the time. The risk/reward ratio is used by more experienced traders to compare the expected profits of a trade to the amount of money risked to capture profit. This ratio is calculated mathematically by dividing the amount of profit the trader expects to have made when the position is closed (the reward) by the amount the trader could lose if price moves in the unprofitable direction and the trader is stopped out for a loss.

Some people, especially those that like to sell option premiums, are OK with having a very low reward if they have a high probability of profit.

Let’s take a look at how setting up the proper risk/reward profile for each individual position will boost overall profitability.

A big secret that many rich traders know (and new traders do not) is that even the best traders only win about 50%-60% of the time. But even though they’re not winning every trade, they still make money hand over fist.

The secret to their edge?

Big winners and small losers.

Big losses will kill your account quickly, and small wins will do little to pay for those losses. Our trades have to be asymmetric where our downside is carefully planned and managed, but our upside is open ended. This is a crucial element for trading success and has to be understood and planned for. Consider the following sets of risk/rewards with win rates.

- With a 1:1 risk/reward ratio and 50% win rate a trader breaks even

- With a 1:2 risk/reward ratio and about a 35% win rate a trader breaks even

- With a 1:3 risk/reward ratio and about a 25% win rate a trader breaks even

Another way to view this is how big a “win” it takes to recover from a loss.

My personal style, comfort level, and goal is to set up trades with a 1:3 risk/reward and be right 60% of the time.

The Third P: Probability

My top trading goal is to achieve a high probability for producing consistent profits.

So, for example, in a strong directional trade in which I might be right only 50%, I only want to risk $1 for the potential to make $2 or more. This is the requirement for debit positions in which I’m purchasing options (puts or calls, spreads, or out right).

In order to truly become the “house,” one also needs to know how to employ credit positions that can produce income in a sideways or range bound market. Credit spreads get the tailwind of time decay at your back. Knowing how to take a “walk” to get on base is a crucial part of the game.

I invite you to join Options360 for a full 30 days for just $19

Credit spreads are positions in which you don’t need to do much of anything, except exhibit patience, and you still get to first base.

My basic requirement for credit positions are they should have a 75% probability of expiring out of the money and worthless. The profit from collecting the premium sold should provide at least a 25% return on risk.

I’m talking about positions in which options are sold for a credit. If the value of the options declines, a profit can be realized. The profit is limited to the sale price or premium collected. The maximum profit would be realized if the option expires worthless.

Typically credit positions involve puts, calls, or a combination of both that have strikes that are out of the money. That means the options have no intrinsic value; their value is entirely premium. In this sense the seller, or “writer” of options is acting like an insurance company; you collect the premium but you also assume the often risk of making a large payout or loss if there is an adverse event.

To offset this inherently asymmetric risk/reward profile we need to create a situation that not only has a high probability of success but also make sure we are collecting enough premium for the risk we are assuming.

The first and foremost way we limit and manage our risk is to never sell or short options naked. We always use some form of a spread. A typical credit spread involves selling a put or call and then buying a further out-of-the-money put or call for a lower price.

The 75% Solution

While I have the probability of profit in my favor, I want to further manage risk. I use basic rule of thumb to close positions once either 75% of profit has been realized or a 75% loss has incurred.

You can create a sliding scale along a time frame. Such as if a 50% profit could be realized within a matter of days it may make sense to close the position. If you’re suddenly facing a 50% loss clearly something in your thesis of range bound or declining volatility environment was wrong and it may be best to just vacate.

But no matter the time frame, if an option you’ve sold short has declined to less than $0.10 a contract, then buy it back and cover yourself. At that point, the risk/reward becomes too asymmetrical. Don’t try to squeeze out the last dime of premium, it would cost you multiple dollars.

There are two additional “P’s” I like to talk about.

The first is taking an overall Portfolio approach. Having a balance of long and short positions. Having a balance of debit and credit positions. Adjusting overall exposure up or down based on market conditions.

As an option trader, I love market volatility as it presents opportunities. But I do not want volatility within my portfolio. I want to achieve consistent, repeatable returns without big draw downs.

The second additional P is that you should always be Prepared to Lose

You must be prepared to experience losses, it’s simply part of the game. Depending upon your approach you can control the size and frequency but losses will happen. This is true even for those that think they have a “system.”

Take card counting; it’s simple on paper but maddeningly hard in practice because even successful card-counting means long, tiring stretches of losing money, which most people can’t stomach. The casino usually has a 0.5% edge over blackjack players. A good card gives a player about a 2% edge over the house.

A 2% edge is enough to secure a fortune in the long run. But it also promises hell in the short run.

You have to be able to survive long enough while constantly absorbing manageable damage. Many people can’t, or refuse to, do that.

I invite you to join Options360 for a full 30 days for just $19

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.