It’s The Running Of The Bulls…

By: Steve Smith

I’ve been very impressed with the market’s strength and what seems like investors flushed with the Fear of Missing Out (FOMO) emotion. The bullish action is a huge disconnect from what continues to be negative sentiment. This is a case of watching what they do, rather than what they say.

I’ve been leaning bullish, and looking at the momentum in the market currently, for good reason.

Options 360 has enjoyed some great momentum as well. Recently, we closed a bullish SPY position for a 23% gain over the 8 day holding period. Where else can you put down any amount of money and pick up a gain like that in just over a week?

The market shows no sign of slowing down.

Get a one month trial to Options360 for just $19

One clear sign is the surge in call buying over the past two days. So far this week, 7 out of every 10 options trade were call options. This is a year to date high and approaching levels seen during the retail option craze of 2021. This time we are seeing institutions buying large blocks of calls not just in individual names, but the major index ETfs like SPY and QQQ.

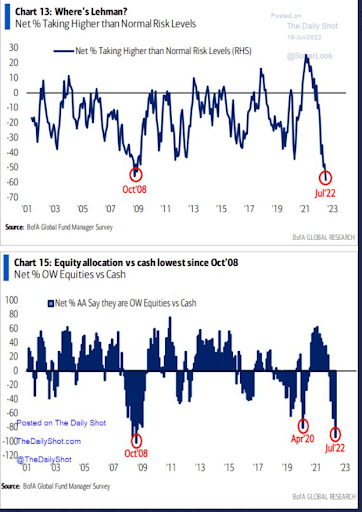

I think some of the reason for this action is simply that money managers had become very underexposed as they de-risked during May and June. As you can see the percentage equity allocation had dropped below the 2020 pandemic levels and matched the depths of the 2008 financial crisis.

This speaks to the high level of uncertainty created by inflation and the Fed’s ever changing policy positions.

Now, with commodity prices seeming to have crested, it looks like the Fed, which trotted out a bunch of hawkish comments yesterday, is getting what it wants without having to get too aggressive with rate hikes.

This may become a unique case in which the market fights the Fed, and wins. And if the market is winning, you can expect Options360 and its members to win too.