The Market Is Fighting The Fed… And Winning

By: Steve Smith

There is still a debate as to whether the current run-up in stocks is a “bear market rally” or the beginning of a new bull run.

My stance is: I tend to stay away from the business of predicting. I respond to price action and what the market gives me. Having bias one way or another can very easily get you into trouble.

We adapt to market conditions and apply a variety of strategies to profit in any environment.

The fact is the major indices have now rallied some 16% from the June lows. To put that in perspective, since 1950, there have been 48 bear market rallies. Of those, six have exceeded 13% and only four have exceeded the current rally (16%).

If this does, in fact, turn out to be a bear market rally, it will be one of the largest ever. That June low is getting further away in both time and price. If the market were to roll over and take out that low within the next 6-12 months, it would qualify as the worst failure on record.

One of the items bears are holding onto is that the recent rally has been fueled by squeezing shorts, especially in the most beaten down names.

And the resurgence of some meme names suggests we are just setting up for another bruising. While this could be true, I counter with;

- All bottoms start with short covering, but we have seen market breadth expand over the past two weeks. Now, more than 65% of S&P 500 stocks are above their 50-day moving average.

- Those playing the meme game may get burned, but this also speaks to the resilience of retail investors. They are nowhere near panicking or capitulation. Money keeps flowing into the market.

What is most surprising to me is how this rally has gained steam even in the face of the Federal Reserve maintaining they are hell bent on rising rates until further notice.

Check Out Options360 for just $19!

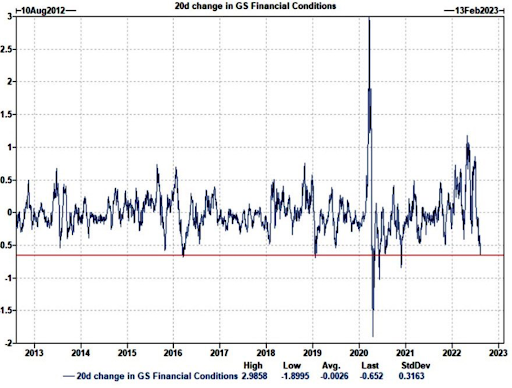

If we look at the Goldman Sachs Financial Conditions Index we see it has eased over the past month at the fastest in a decade, and is back towards levels in when fiscal and monetary measures were much more dovish.

Goldman Sachs financial condition index considers items such as interest rates, corporate credit spreads, stock market valuations and the exchange rate. Basically it refers to the availability and cost of credit.

Interest rates have moved lower, corporate spreads have narrowed (and there has been a surge in junk rated issuance), the stock market is up, and the dollar is at a 40-year high.

The fact commodity prices, particularly oil, have dropped some 25%-35% over the past two months bolsters the case we’ve seen peak inflation, and pivot is warranted. However, this is not the outcome the Fed hoped for with their aggressive rate hikes and hawkish talk.

Once again, we see the market is fighting the Fed by fully pricing in a dovish pivot by the end of the year. So far stocks are winning…

See how we are playing the market using the link below. It’s never the wrong time to learn this high-income skill.

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.