Big Tech Took It On The Chin This Week

By: Steve Smith

The feature this week was earnings reports from Microsoft (MSFT), Amazon (AMZN), Meta (META), Alphabet (GOOGL), and Apple (APPL); the first three out of the four were major disappointments and sent their shares to new 52-lows.

At this point, I think we can retire the FANG, FAAMG or whatever was the latest acronym for this cohort for a new one, MAMAA. Netflix (NFLX), one of the original members, was booted last summer when it lost 75% of its value between November of 2021 and June of 2022.

Join us in our Options360 community for just $19 for the first month

Basically, these mega-caps, which had led the market for over a decade and had held up relatively well over the past 18 months, are finally ‘catching down’ to the broader market.

Actually, it’s more like a convergence. Cloud based software was where the weakness was for MSFT, GOOGL and AMZN, which have taken it on the chin this week. The generals are in retreat while the foot soldiers are advancing.

For example, energy, consumer staples, and recessionary plays have been moving higher. In fact, names like Exxon (XOM), Dollar General (DG) and McDonald’s (MCD) are at new 52-week highs.

If you compare the Invesco S&P 500 Equal Weight ETF (RSP) to the market cap weighted SPDR S&P 500 ETF Trust (SPY),you can see the former is down just 12% on the year, while the latter remains down 18% YTD.

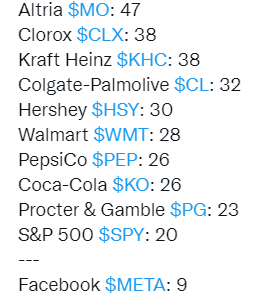

Shining a light on how dramatic the rush into safe or supposedly ‘recession proof’ companies is the incredible differential in valuations. Sticking with a basic P/E multiple, it would be an understatement to say the consumer staple sector has become very richly valued.

I don’t think those valuations are sustainable; not from a growth standpoint and certainly not as bond proxies. With 1-5 yr rates all north of 4%, a dividend yield of 2.5%-3% is no longer as attractive as when interest rates were zero.

I’m still of the opinion that we are not quite in a recession as the labor market and consumer spending remains strong, as well as balance sheets continuing to be relatively robust.

I’ll be keeping my eye on these staples stocks, and through the iShares U.S. Consumer Goods ETF (IYK), looking for a bearish play.

Catch this possible trade and many more by joining Options360 today!

I look forward to trading with you!

To Your Success,

Steve

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.