Many Traders Avoid This At Their Own Peril

By: Steve Smith

Options Sensei is just one part of the WealthPop brands, however, as we are all options traders, we are also huge proponents of education. Continuing education, meaning it never stops…

The resources WealthPop offers takes many forms, across many different traders and strategies. Education provided through things like live webinars, class or individual coaching, online tutorials (both live and recorded), suggested reading/homework, even spur of the moment group meetings.

No matter whose course you pursue, the discipline to maintain a never-ending commitment to learning and self improvement needs a combination of personal drive and supportive resources.

In the coming weeks, Options360 hopes to provide even more of the highest quality education out there. Which is why we will be including free access to Option Academy’s weekly call I host with Mike Honig, another WealthPop instructor.

Again, it’s free to any current member and it is where we answer questions, make suggestions and hopefully, ‘teach a man to fish.”

Get unlimited access to Option Academy as part of you trial to Options360 for just $19

But we all know the proof is in the pudding.

Some initiates feel confident because they’ve done so much research, book learning, and back tested modeling they jump into their first live account with high expectations, a puffed out chest and yes, even bragging if they find some success early on.

What usually happens is a shrinking away from the task of learning, which almost always correlates to a diminishing account value. You can call it quitting, intimidation, or just a realization some people’s personalities are not suited for the (nonsensical) trading game.

Over the next few weeks, I will cover not just the basic strategies, but which of these best align with your specific market approach.

Join the best option community for just $19 for a one-month trial

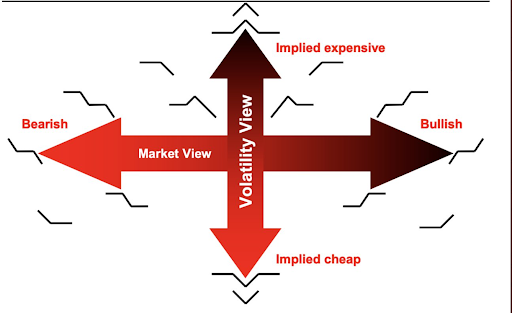

This a basic image to begin thinking in terms of strategies during specific market conditions and your specific outlook; both through time and price.

Options360 will keep pumping out trades, but now I want to provide added value to educate and allow members to take ownership of their own financial freedom.

To Your Success,

Steve

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.