The Clock is Ticking…

By: Steve Smith

2:00 PM has come and gone. Not only was that the deadline for me to turn in this article but it was when the Fed finally released the decision on interest rates, which was then followed by a press conference with Chairman Powell.

Will this be the catalyst that finally breaks us out of a range? Look at the market today and you be the judge.

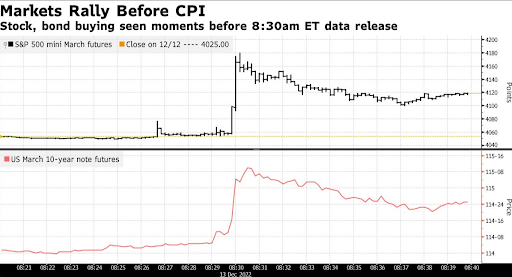

Yesterday’s CPI looked like it might get it done; a cooler-than-expected number caused the S&P 500 Index to rocket up some 3.4% on the opening bell–remember options were pricing in a 3.1% move–only to beat a hasty retreat and remain range bound for the rest of the day.

Retail FOMO buying, institutional selling…

Peak inflation is yesterday’s news. The story for 2023 will be economic downturn and earnings decline, which hasn’t been priced in yet at the index level.

Looking at the SPY option chain, we see the implied volatility for options expiring on Tuesday and Wednesday are near the 50% mark, the highest reading for any expiration in over six months. It suggests market’s are pricing in a 3.15% move on each day.

So, for now, SPY is still stuck in the $390 -$410 range it’s been in for the past month.

Actually, I should clarify, SPY actually traded as high as $416 moments before the 8:30 AM ET release of CPI data in what is called in an article by Bloomberg “highly suspicious activity” suggestive of a leak. I know I, as well as other traders, were certainly scratching our heads, not just at the action minutes before the release, but the run-up into Monday’s close.

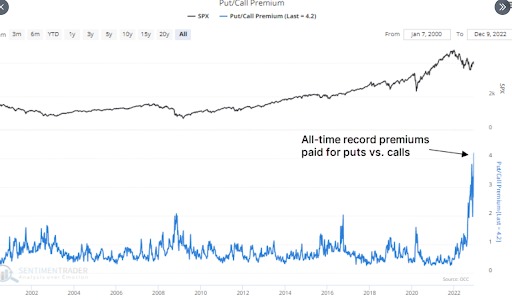

One of the other interesting things about yesterday’s action, and emblematic of the conflicting narratives over the past few months, is despite the positive price action there was a huge rush into buying put protection over the past few days.

According to the Options Clearing Corp., traders across all U.S. exchanges bought to open $4.20 in put options for every $1 in call options.

That’s double what they spent during all the other panics over the past 22 years.

Also making the recent price action noteworthy, and possibly a case that the recent run up from the October lows was just another bear market rally, it was only the 15th time the SPY has gained 1% and then gapped up over 2% the following day.

As you can see from all instances below most occurred within bear markets with a heavy concentration during the 2008/2009 financial crisis.

- 12/13/2022

- 10/18/2022

- 4/7/2020

- 10/27/2011

- 4/9/2009

- 4/2/2009

- 1/28/2009

- 12/8/2008

- 11/25/2008

- 11/24/2008

- 10/14/2008

- 9/19/2008

- 7/29/2002

- 6/2/2000

- 10/12/1998

The clock is ticking, the next move comes, not just on the day of FOMC, but the days the follow. You already know we are are going to keep our head on a swivel and take advantage of any opportunities that rear their ugly head.

Let’s see if we can break loose from this range first. Then, we feast.