How To Find Investment Themes To Boost Your Account

By: Steve Smith

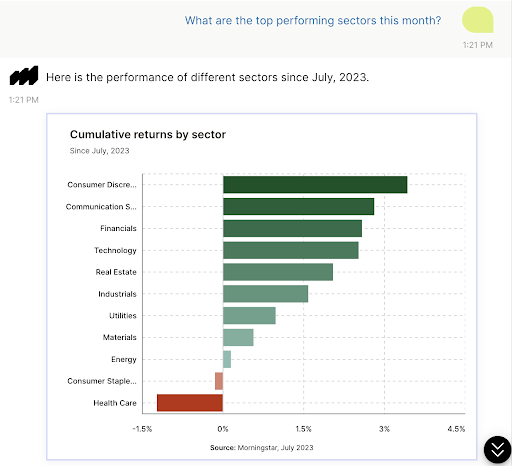

Artificial Intelligence has been invading nearly every aspect of our lives and nowhere is this more evident than personal finance. As investors look to take control of the finances and build wealth, they are increasingly embracing thematic investing. In other words, finding a trending market story and investing behind it.

According to a recent report from Morningstar, the demand for new thematic investment solutions has skyrocketed in recent years, spurring the launch of a record 602 new thematic funds globally since 2020, up from 183 in 2019. Assets under management in these funds grew to just over $870 billion by year-end 2022, a nearly threefold increase in just three years.

These funds promise concentrated exposure, regardless of sector, to new and exciting themes in hopes to draw interest from retail investors and financial professionals alike.

Like a new car off the lot with a fresh coat of paint, these funds are designed to turn heads. However, if investors take a closer look at their holdings and construction methodologies, they frequently come away disappointed by what lies under the hood.

Magnifi was built as the world’s first AI investing app nearly a decade ago to help investors identify robust themes and avoid pitfalls or flash-in-the-pan products.

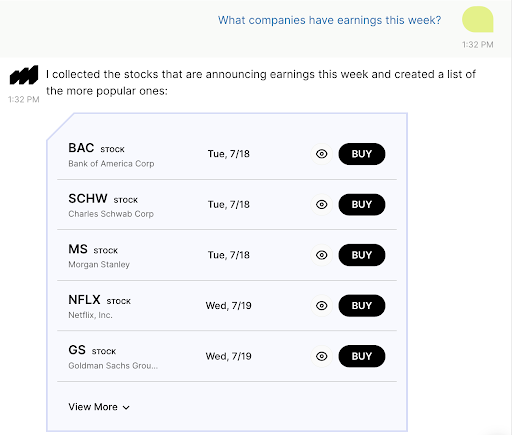

To make the most of the deep analysis Magnifi can provide, investors can use the AI software in order to help further their financial education and even keep track of what companies have earnings coming up by asking questions like, “What companies have earnings this week?”

Represent a secular trend that will persist for at least the next 10 years. Provide meaningful economic benefits to a…

Continue reading at WEALTHPOP.com