Options Trading: This Retailer Has Gone Way Too Far

By: Steve Smith

Photo Source: Flickr.com

Shares of Wayfair (W), an online retailer of furniture and home goods, have been on tear, but now it looks like it’s gone too far. Here’s a low-cost way to use options trading for a pullback.

On Aug. 2nd, the company reported second quarter results, showing solid topline revenue growth of 37% with total sales set to exceed 41 billion in fiscal 2018. The number of active customers rose 34.0% and orders per customer increased to 1.82 from 1.74. Average order size was $254, vs. $258 a year ago. That was the good news.

The bad news was the EBITA losses of $67 million or $0.77 per share, both significantly larger than the expected $35 mm and $0.29 eps anticipated by analysts.

So, what has the stock done since these ‘disappointing’ results? Only gain 35% over the past six weeks.

Source: StockCharts.com

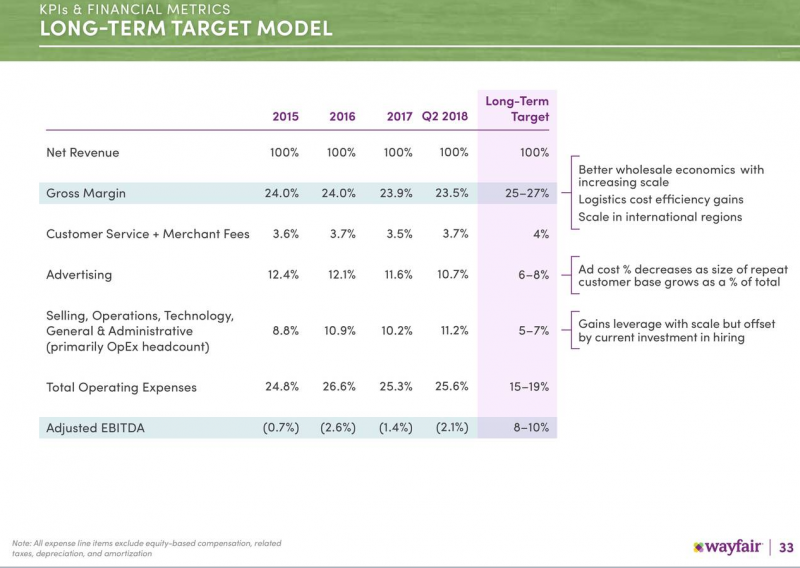

There is no denying the company is growing fast. But many of the key metrics go in one direction, while the company’s long-term targets are in the other.

Source: Wayfair Quarterly Report

It seems market prices the stock on faith the company will eventual turn each trend and based meet those long term targets.

But given these projections seem optimistic under the current environment of solid consumer demand what happens if and when the economy slows or enters a recession?

Even if we assume over the long term they meet those targets and Wayfair expands its market share the overall market for furniture simply won’t grow to match the valuation.

The market is pricing in a business that in 10 years will have a $30 billion-plus sales base, and 4-5% share of a $750 billion-plus market vs. about 1% today the current valuation it to exceed market position Restoration Hardware (RH) Williams Sonoma (WSM) and At Home Group (HOME) category combined.

And there is Amazon (AMZN) always lurking in the wings. If Wayfair shows it can not only grab a larger slice of the home goods pie, but also make money doing it, one can expect Amazon to aggressively go after that profit margin.

The Trade:

The long-term fundamental valuations of the company aside, I think the stock is ripe for a pullback in the coming weeks. Here’s where the options trading comes in.

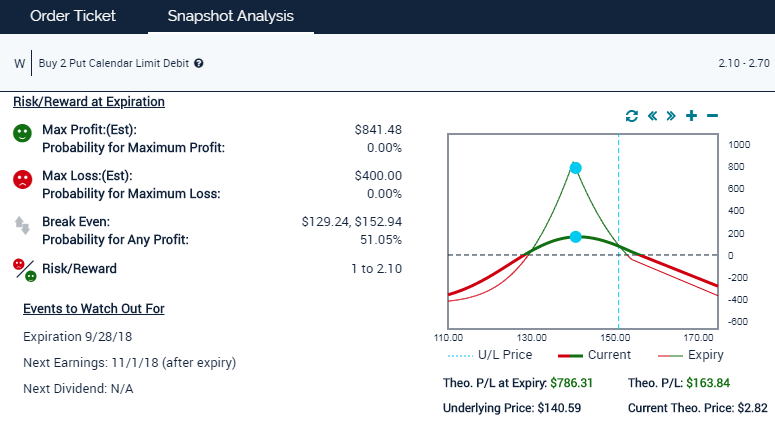

A good, limited-risk way to play for a move back down to the $140 level is through a put calendar spread. Specifically:

Buy the Oct. (10/19) 140 put and sell the Sept. (9/28) put for a $2.00 net debit.

This position will benefit from both time decay and a decline in the share price.

As this risk graph shows, the initial maximum profit would be achieved if shares are at $140 on the Sept. 28 expiration date.

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.