A Shocking Divergence Between Main Street & Wall Street

By: Steve Smith

The new year has started off with some surprising divergences in both people’s behavior and stock price action.

From a big picture perspective, we talked about how Wall Street doesn’t necessarily reflect Mainstreet, which became abundantly clear during the first few months of the pandemic. Through most of 2020, while businesses struggled through lockdowns the major stock indices, mostly powered by the mega-cap tech names, went straight up and began hitting all-time highs on a regular basis.

By the time vaccines started being given in early 2021 — allowing for reopening and unleashed pent-up demand — Main Street was seemingly aligning with Wall Street bullishness as an economic activity; helping to drive GDP growth to its highest since post-World War II.

But now with inflation remaining stubbornly high and Omicron spreading like wildfire, it seems we’re once again at a place where Main Street is heading in the opposite direction as Wall Street.

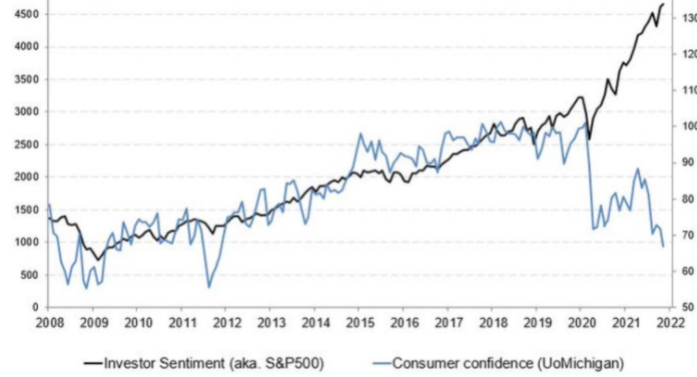

While the University of Michigan Consumer Confidence Index has never been a great short-term predictor – since people have a tendency to say one thing and do another – it has generally tracked the stock market for 10-plus years.

However, that correlation broke at the onset of Covid. What’s confusing is that they continue to decouple. Consumer Confidence actually made a new low below the March 2020 level while Investor Sentiment continues to move higher.

I suppose what drives prospects, profits, and Fortune 500 companies may not be reflective and even conflict with the majority of individuals’ financial situations.

CEO confidence is high due to profit margins expanding, stock buybacks surging again, and the ability to raise prices at will occurs; due to the concentration of industries.

Meanwhile, consumer confidence is sinking due to prices rising faster than income, the end of government stimulus checks, and loan forgiveness. This has led to an increase in debt loads with schools starting to close down again.

This macro divergence doesn’t really provide us with any specific actionable trade ideas. However, it’s important to have a 10,000-foot landscape view to help us identify how we might maneuver among the trees.

Tomorrow, I’ll focus on a more actionable divergence among specific stock and sector performance. Mainly, how high valuation shares and profitless tech companies are being burnt to the ground while old-line legacy companies have seen their stocks catch fire. And by fire, I mean “hot” in a good way.