Is an Economic Hurricane on the Horizon?

By: Steve Smith

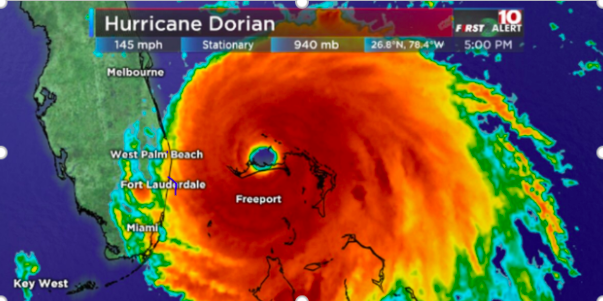

This weekend’s Hurricane Agatha is a perfect analogy for the current market climate. We have meteorologists and technical analysts each culling data to build predictive models with a variety of “it could go here” and “if/then” scenarios.

This creates the cone of uncertainty with the hurricane’s landfall unknown.

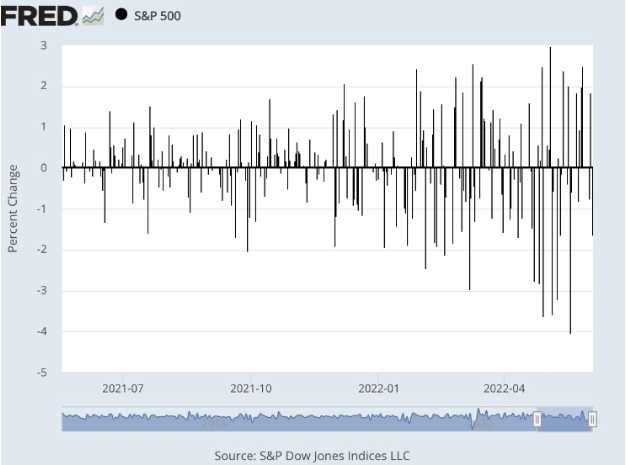

For stocks, the SPDR S&P 500 (SPY) is whipping back and forth with many of its daily moves over 2% with each data point hitting the tape. However, it’s essentially bound by the important $380 support and $420 resistance levels.

It seems that the side of the box that it ultimately breaks will determine the direction of the market and economy — and possibly the country’s politics. Until that occurs, it seems bulls and bears risk getting chopped up as we go nowhere fast.

This reminds me of 2019’s Hurricane Dorion. The natural disaster parked itself off Florida’s coast for days prior to swinging north and sparing total devastation.

I remember driving inland and hunkering down in a hotel for 5 days, cursing and begging for that storm to just move somewhere, anywhere.

For now, the Options360 trading service is using iron condors to collect premium as we wait out the storm.

Just as meteorologists never saw a hurricane of Dorian’s magnitude stall in place and gather in size, economists and investors never witnessed the phenomenon of monetary policy shifting from negative rates to aggressive hiking.

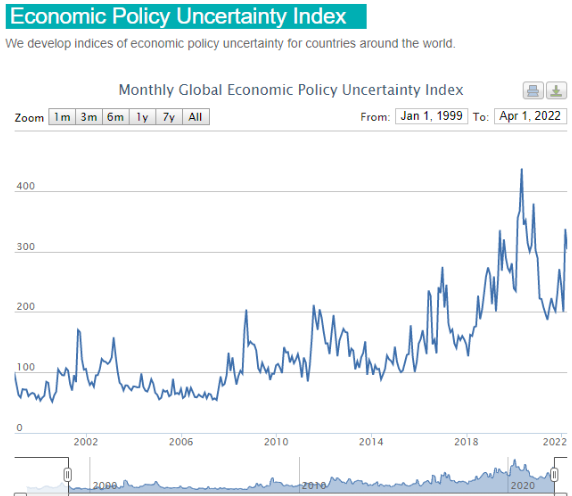

This has confused investors to no end, causing the Bank of America Economic Uncertainty Index to surge towards its highest levels since the initial pandemic spike in 2020.

The confusion is leading to equaling confounding, and often contradictory behavior; people chasing risk assets such as stocks and safety, simultaneously.

The major stock indices are still about 15% from all-time highs. However, volatility keeps creeping higher. We’re seeing daily price swings increase dramatically in the past few months.

People simply don’t know where to turn. Can the Fed perform the soft landing of tempering inflation without sending the economy into a recession?

For now, just as hurricane Dorian swirled offshore bound between two high-pressure systems, the market is casting a worrisome eye on an upcoming storm.