How We Trade Earnings Season

By: Steve Smith

Earnings Season is indeed upon us. Yesterday, I hosted a webinar detailing the Earnings360 approach to trading earnings reports. The first…

trade recommendations will be issued next Monday so there’s still time to get in and not miss a trade. In the next six weeks, I expect to make about 30 trades during an undoubtedly action-packed earnings season.

The Earnings360 Presentation Here For Free

During the event, I explained my process and revealed the strategies that led to the Earnings360 service producing consistent profits for 16 out of 17 quarters in the past four years.

Honestly, even under ideal circumstances, earnings can be extremely tricky to trade as these trades can have many moving known, as well as unknown parts. Will the company miss or beat expectations? What will be the guidance? Will traders “sell the news,” or buy “the unknown,” believing the recent decline has priced in as a near-worst-case scenario?

However, there’s one predictable pricing behavior that savvy option traders use to make steady profits. Given all the recent volatility and numerous unknowns in the market, options premiums will be at record-high levels as market-makers must price options for outsized moves.

So, how do you trade earnings in a world without guidance? Here’s a quick guide that rests on taking an options-centric approach.

Use the Post Earnings Premium Crush (PEPC) strategy.

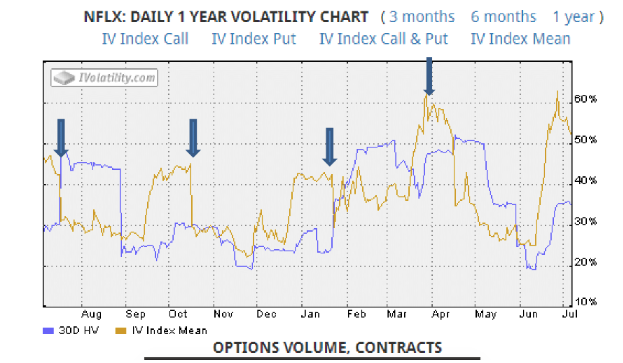

No matter what a company reports, or how the stock reacts, the options will undergo a Post Earnings Premium Crush (PEPC). This is my way of labeling how implied volatility contracts, immediately following the report, no matter what the stock does.

As you can see, the repeating implied volatility pattern of Netflix (NFLX) options is spiking and retreating in the quarterly reports.

You’ll often hear traders cite what percentage move options are “pricing in” the earnings. The quick back-of-the-envelope calculation for gauging the expected move magnitude is to add up the at-the-money straddle.

This article does a great job of explaining how to use the straddle to assess expectations and potentially profit.

Watch The Earnings360 Replay Here

Once option traders are armed with this knowledge, they advance to using spreads to mitigate PEPC’s impact when looking to make a directional bet. Some will graduate to getting this predictable pricing behavior in their favor by selling premium via strangles, or the more sensible limited-risk iron condors. But, these strategies still carry the risk of trying to predict, if not the direction, then the move’s magnitude.

While the Earnings360 option-centric approach isn’t a guarantee, it does stack the odds in our favor by getting the PEPC tailwind at our back. All Earnings360 trades use some form of a spread to give us a high probability of profit while assuming a limited risk.

In my next article, I’ll describe the Pre-Earnings Premium (PEPE) strategy to take advantage of options pricing behavior prior to the release of the report.

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.