This Major Market Has Reached Complete Crisis Mode

By: Steve Smith

I’ve been harping on the problems a surging U.S. dollar might present not only for stocks but for the global financial system.

By golly, I think dey did done gone broke it.

Currency markets are now in complete crisis mode.

Stocks tried to rally this morning as the June low held and oversold readings were blinking all around.

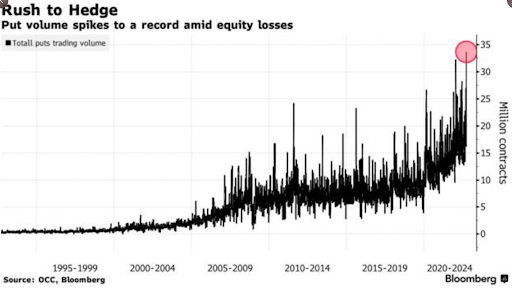

One of the data/images being widely shared this weekend was the rush to buy puts, which hit record on Friday. In the image below, you can see a general uptrend in the image thanks to the adoption of options. But the spikes are unmistakable and suggest some minor panic was in the air.

I’d like to note this surge in put buying comes after institutions (mistakenly) let their hedges roll off after the September 16 monthly expirations.

On that day I wrote:

A last item to take note of is that while institutions had loaded up on put protection during August and early September, most of those hedges, estimated to be $2.1 trillion in notional value, will roll off on today’s option expiration.

The reason for letting those puts expire without placing new hedges is the institutions have been selling stocks to aggressively reduce risk over the past two weeks. But they still have plenty of exposure, and without a safety net of put protection underneath current levels, the market is vulnerable to a tail risk event. This could lead to a situation in which selling begets selling.”

Today Options360 just stepped and established a bullish position in the iShares 20+Treasury (TLT) — which is an ETF proxy on bond yields — on the premise the downside (higher interest rates) is somewhat limited. At this point, I think bonds have priced in the combination of more rate hikes, possible peak inflation, and a possible recession as the curve is inverted.

But there our two main catalysts for a move higher:

- Signs of a pivot from the Fed.

- A flight to safety should equities unravel. We saw TLT reverse higher on Friday as selling in stocks accelerated.

Don’t miss the next trade. Join Options 360 for just a $19 one-month trial

Once big maco trends (especially in currencies) gather momentum, they have inertia, which is difficult to reverse without a major counter force.

Right now, we have oversold conditions, extreme bearish sentiment, and some readings (breadth, put/call, RSI) tickling levels associated with if not total capitulation, then at least short-term lows.

It still seems the June low needs to go but needs to navigate around face ripping rallies.

I would love to capitalize on these large price moves, but patience might be the more prudent move.

There’s a bunch of Fed speakers this week. Those clowns really think the way to fix 10 years of their boneheaded policy is to push for more unemployment as a solution to the inflation they created.

Options360 has two toes in the water, but we’re mainly keeping our powder dry until we see a safe place to dive in.

About author

Steve Smith have been involved in all facets of the investment industry in a variety of roles ranging from speculator, educator, manager and advisor. This has taken him from the trading floors of Chicago to hedge funds on Wall Street to the world online. From 1987 to 1996, he served as a market maker at the Chicago Board of Options Exchange (CBOE) and Chicago Board of Trade (CBOT). From 1997 to 2007, he was a Senior Columnist and Managing Editor for TheStreet.com, handling their Option Alert and Short Report newsletters. The Option Alert was awarded the MIN “best business newsletter” in 2006. From 2009 to 2013, Smith was a Senior Columnist and Managing Editor for Minyanville’s OptionSmith newsletter, as well as a Risk Manager Consultant for New Vernon Capital LLC. Smith acted as an advisor to build models and option strategies to reduce portfolio exposure and enhance returns for the four main funds. Since 2015, he has worked for Adam Mesh Trading Group. There, he has managed Options360 and Earning 360, been co-leader of Option Academy, and contributed to The Option Specialist website.

Related Articles

-

-

Don’t Fall For Faulty This Faulty Indicator

December 23, 2022 -

If You Missed Our Big Event, We’ve Got You Covered

December 21, 2022 -

How I Gave My Readers a Shot to Turn $10,000 into Over $537,000

December 19, 2022

Subscribe To OurDaily Newsletter

Join our mailing list to receive the latest news and updates from Option Sensei.