What Does The Crypto Crash Mean For You?

By: Steve Smith

In the wake of another spectacular failure in the crypto space, namely the bankruptcy of FTX and the fall of founder Sam Bankman Fried from savior to fraud, or perhaps patsy, it’s hard for not to spill a bit of ink on the topic.

First of all, not to make light of the incredible losses many have suffered, but as a finance journalist, development of Web 3.0 is the gift that keeps on giving.

This is not going to be “I told you so” but rather what lessons can we “re” learn from the latest crypto fiasco, such as the implications it might have on the broader market.

In fact, I don’t think there is much risk of contagion across other financial markets, whether it be equities or bonds; crypto is still a small ecosystem and the latest debacle will keep it ring fenced from institutional risk for the foreseeable future.

Full disclosure, Options360 has never recommended buying or selling any crypto tokens, NFTs or even the exchanges such as Coinbase (COIN).

Options360 is now up 29.2% year to date. Get in on all the trades now!

As far as what we can learn. We can start with the obvious, nothing goes up for ever, nothing delivers double digit risk-free rate of return, and nothing in an unregulated market. Especially, with a history of hacks, scams, and money disappearing on a regular basis. It shouldn’t be treated as anything less than a purely speculative lotto ticket.

That’s not to say I haven’t dabbled in my own accounts trying to learn about BTC and the mechanics of blockchain. I did recommend a year ago for Options360 students to establish a bearish put spread on RIOT Blockchain (RIOT) when it was trading $25, only to see it go to $45, and then we escaped at breakeven when the sector started unraveling.

I’ve been on the ‘early’ side of many manias, from the dot com era in 2000, to housing in 2008, and now Web 3.0 in 2020. I made a tiny bit of money in each case, but it was not worth the risk.

Recall the famous saying, “the market’s can remain irrational longer than you can remain solvent.” I was happy to exit at breakeven; but of course, gnashing my teeth when the collapse came in each case.

But crypto is a slightly different beast. It had the euphoria for a new technology, becoming a breeding ground for scams, a unique situation of an unregulated environment that allowed “pump and dump” which basically led to an ongoing ponzi scheme.

Before getting to the basic rip off, let me make one point;

Throughout history the development of financial markets, from grain trading in Egypt to the Buttonwood Tree that established Wall Street, the markets were always built on a true economic purpose; raise capital for companies to invest in their growth, allow commodity producers to hedge costs or lock in prices.

The speculative trading, hedge funds etc, came later.

Crypto, at least in the last few years, flipped its head. Speculation came first as thousands of tokens were created with no true economic purpose. I’ll trade you two Shibu’s for one Doge. Wha?

This is getting long and late in the day, but my point is, we don’t take part in speculation in Options360. Just look for opportunities and capitalize on them, or we don’t take the trade. Its really that simple.

If you want me to follow up, email me at Steve@admesh.com

Juts remember, what goes up… well, you know the rest. Keep in mind, if something seems to be good to be true; it likely is.

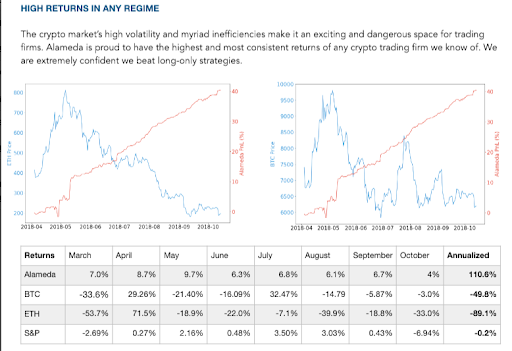

Interesting to note thought, when FTX’s trading arm Alameda Research presented a whopping 3 page deck on expected returns it looked… very similar to Bernie Madoff’s claims of 15% returns, risk free, under any market environment.

People say there were plenty of red flags. But nothing stands out to me more than this April 2022 interview between Bloomberg’s Matt Levine and FTX’s Sam Bankman Fried (SMB).

The whole thing is worth a read, however, here is a bit of the few jaw dropping give and take.

Matt Levine:

Can you give me an intuitive understanding of yield farming? I mean, like to me, farming is like you sell some structured puts and collect premium.

SMB:

Let me give you sort of like a really toy model of it. You start with a company that builds a box and in practice this box, they probably dress it up to look like a life-changing, you know, world-altering protocol that’s gonna replace all the big banks in 38 days or whatever.

So then, you know, X token price goes way up. And now it’s $130 million market cap token because of, you know, the bullishness of people’s usage of the box. And now all of a sudden of course, the smart money’s like, oh, wow, this thing’s now yielding like 60% a year in X tokens. Of course I’ll take my 60% yield, right? So they go and pour another $300 million in the box and you get a psych and then it goes to infinity. And then everyone makes money.

Matt:

I think of myself as like a fairly cynical person. And that was so much more cynical than how I would’ve described farming. You’re just like, well, I’m in the Ponzi business and it’s pretty good.

SMB:

It’s just a box. So, you put it into the box and you get like, you know, an IOU for having put it in the box and then you can redeem that IOU back out for the token.

Matt:

Wait, wait, wait, from like first principles, it should be zero, but okay

SMB:

I mean, that’s not quite true, but, like, when you describe it in this totally cynical way, it sounds like it should be zero, but go on…

And there it is, it should be zero, and it is zero.

Stay away from sure things and anything that seems too good to be true.

To Your Success,

Steve