How I’m Managing My SPY Trade

By: Steve Smith

Roughly a month ago, in the days prior to the election, I revealed how I established an iron condor position in the SPDR 500 Trust (SPY). My dual thesis was that post-election implied volatility would decline significantly, and the SPY or stock market would settle into a fairly well-defined range.

I was 100% correct on the first point as implied volatility in the SPY declined from 38% pre-election to its current 20% level.

Learn about the service investors are saying is, “The Best $19 You’ve Ever Spent” — The Options360

However, on the second component of SPY staying range-bound, I was severely wrong, forcing me to make several adjustments over the past few weeks. I thought it might be instructional to share the specifics of adjustments, my reasoning behind them, and where the position now stands.

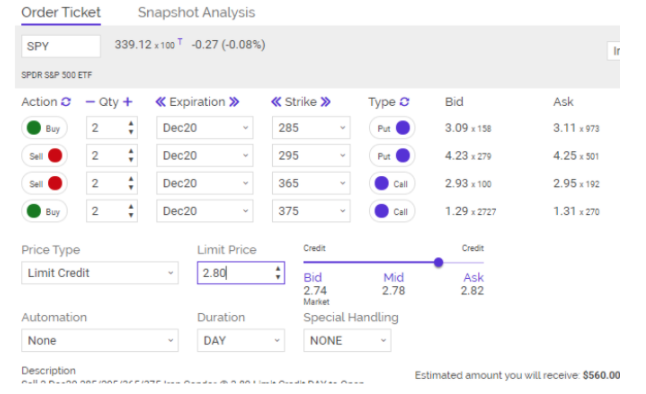

On 10/27, with the SPY trading around $338, I initiated an iron condor using the 285/295 puts and the 365/375 Calls for a $2.80 Net Credit.

The inside strikes of 295 and 365 were each about 10% out-of-the-money with a 0.11 delta, meaning they had a nearly 90% chance of expiring worthless. Coupled with the expected decline in implied volatility and the inexorable march of time decay (theta), I figured I’d achieve 50% of the maximum profit within two to three weeks.

But, a funny thing happened as I was counting my chickens; the SPY historically rallied, running almost 11% in just 5 trading days pushing through the short 365 strike. Uh oh!

[Limited Spots Available] Sign up for my Options360 Service to lock in your $19 TRIAL OFFER

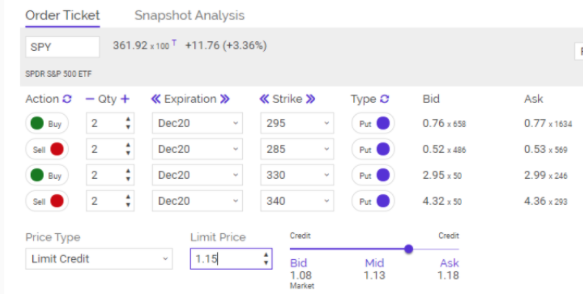

After white-knuckling this breach of my inside call for a day, I took action on 11/9 when the SPY pulled back towards the 360 level. The adjustment I made was to roll up the position’s put side, dramatically, to collect a good chunk of premium. Specifically, I rolled the existing 285/290 spread up to the 330/340 strikes for a $1.10 credit.

The resulting position was an iron condor in the 330/340P-365/375C for a $3.95 Net Credit. Meaning we collected $3.95 which represented our maximum profit, but the risk was still $6.05. This is calculated by the width between strikes minus the premium collected ($10.00 – $3.95 + $6.05). The position got some relief in mid-November as SPY pulled back and volatility continued to subside.

But, last week a new rally commenced leading me to make a more drastic decision adjustment, one focused on risk reduction. As I wrote to Options360 members in Monday’s Alert, “ We are taking two steps here to reduce risk. It’s a two-step process, first, close half (1 contract) of the iron condor for $3.90 or around breakeven. Second, roll the remaining position up and cut the width between strikes to 5 from 10 wide.”

Grab a Trial Options360 Membership for Just $19!

After the adjustments, the new position’s an iron condor of a long 1 contract 347 put, short 1 contract 352, short 1 contract 365 call, and long 1 contract 370 call — a net credit of $2.95 with $5 width between strikes.

Although this multi-part adjustment required a $1 payment, bringing our net credit from $3.95 to $2.95, the crucial element was narrowing the width between strikes from $10 wide to $5 wide. This brought our risk down from nearly $1,200 to just $200; an 83% risk reduction. The new position still has a profit potential of $300 on just $200 of risk or the possibility of a 110% return on risk.

However, we’re not out of the woods yet. With SPY rallying through $366 today, I need to start contemplating my next move. But, with the risk mostly removed, my knuckles will no longer be turning white.

[Last Chance] Test Drive the Options360 Service by claiming your special $19 trial offer